Mortgage Loan Documents Required – Posted by Beth Carr on Wednesday, April 7, 2021 at 6:16 pm By Beth Carr / April 7, 2021 1 Comment

Applying for a mortgage loan can be overwhelming, especially for first-time home buyers. This does not mean that preparing for the application process should be so difficult. If you can start with all the necessary documents, you can avoid some of the headaches that come with the mortgage loan application process. If you want your approval process to be as smooth and fast as possible, here are some of the documents you should have when you decide to apply for a mortgage loan.

Mortgage Loan Documents Required

You should keep in mind that while this checklist covers most of the items you need, there may be other items required to process your loan that will determine your unique situation. It is essential that you get a loan pre-approval so that you have a solid idea of your purchasing power, before you start searching and touring homes.

Documents To Submit When Applying For A Mortgage In Spain

We recommend working with a local lender who has a proven track record, great communication, and always closes on time. In addition, a good lender will offer a variety of loan packages, competitive interest rates/closing costs, in-house underwriting, and help you find the mortgage payment plan that fits your budget.

If you have questions about getting a mortgage loan, or any real estate needs, our team is ready and eager to help! Complete the form below and a member of staff will be in touch to discuss how we can meet your unique needs.

If you are looking to buy a house in St. Louis, St. Charles, Lincoln, or Warren County, you can find homes during your search … Read more

There is so much to think about when it comes to buying, closing and moving into a new home. The process can certainly come with many … Read more

Documents Required For The Most Applied Loans Of India

While things seem to be turning around in many parts of the country as interest rates rise, we are undeniably in a seller’s market…Read more

Jobs By Category All Categories Classified (1) New Construction Construction (6) Buy a Home (34) Community (14) Town Council (2) Make an Offer (1) Market Conditions (18) Sell Your Home (25)

September, 2022 (3) August, 2022 (2) July, 2022 (2) June, 2022 (3) May, 2022 (6) April, 2022 (4) March, 2022 (7) February, 2022 (2) January , 2022 (4) December, 2021 (3) November, 2021 (5) October, 2021 (1) September, 2021 (4) August, 2021 (5) July, 2021 (2) June, 2021 (5) May , 2021 ( 3) April 2021 (2) March 2021 (3) February 2021 (5) January 2021 (5) December 2020 (4) November 2020 (4) September 2020 (1) August 2020 (2) July 2020 ( 1) May, 2020 (4) April, 2020 (2) March, 2020 (1) January, 2020 (2) November, 2019 (4)

Adding Value When Buying Your Home Commercial Real Estate Community News Community Spotlight Escrow: Now What? First Time Home Buyers Getting A Mortgage Home Maintenance Debt Home Tips Living In Your Home Making An Offer Market Report Marketing Your New Construction Home Pricing Your Home S.O.S. Selling Your Home Selling Your Home Showing Your Home Grading Your Home The mortgage approval process is often confusing for first time home buyers. We know, because we receive their questions by email on a regular basis! Therefore, we created this guide to guide you through the various steps in a typical mortgage approval process.

Mortgage Loan Processor Resume Sample

Note: The loan process may vary from one loan to another, due to a variety of factors. Therefore your experience may be slightly different from the experience described below. These are the six steps that

We find that people find it easier to understand the mortgage loan approval process when it is explained as a series of steps. So let’s talk about the six major steps along the way (as shown in the image above).

You can think of pre-approval as a form of financial pre-screening. It has “pre” in the name because it occurs at the end of the mortgage loan approval process.

Pre-approval is when a lender reviews your financial situation (especially your income, assets and debts) to determine if you are a good candidate for a loan. They will also tell you how much they are willing to lend you, and provide you with a pre-approval letter to that effect. The lender can also check your credit reports and scores at this stage.

Main Types Of Home Loans And How To Apply For One

This is a beneficial step in the mortgage approval process, as it allows you to narrow down your home search. If you’re going to skip pre-approval and jump straight into the house hunting process, you may end up wasting time looking at homes that are above your price range.

Once you’re pre-approved for a certain amount, you can shop more confidently in that price range. And that brings you to the second major step in the mortgage approval process – house hunting.

We’ve written a lot about the house hunting process. Here are some house hunting tips aimed especially at first time home buyers.

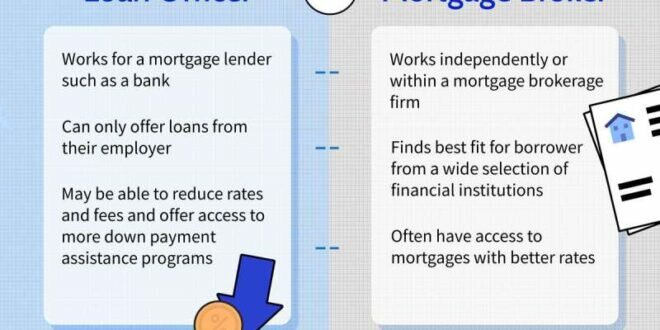

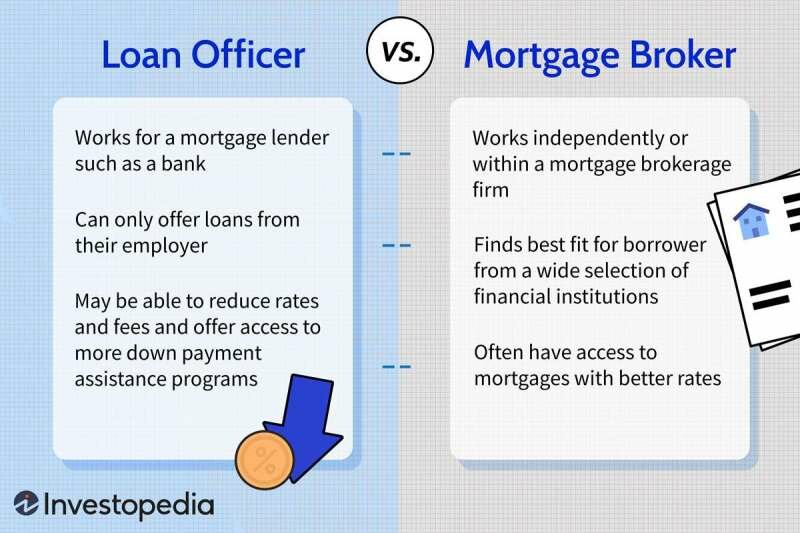

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg?strip=all)

Your mortgage lender is not very involved at this stage. Home hunting is primarily done by buyers and their real estate agents.

Mortgage For A Non Resident

Come back into the picture when you have made an offer to buy a house. That’s when you go to the next stage of the mortgage approval process – filling out an application.

You are pre-approved for a loan. You’ve found a home that meets your needs, and you’ve made an offer to buy it. The seller has accepted your offer. Now it’s time for the next step in the mortgage approval process, which is the loan application.

This is a simple step in the process, as most lenders use the same standardized form. They use the Uniform Residential Loan Application (URLA), also known as Fannie Mae form 1003. The application asks for information about the property being purchased, the type of loan used, as well as information about yourself, the loan.

You can find a sample loan application online: just do a Google search for “Fannie Mae form 1003”.

Stated Income Loans And More For Self Employed Borrowers

Once you have completed a purchase agreement and loan application, your file will move into the processing phase. This is another important step in the wider mortgage loan approval process.

Loan processors collect a variety of documents related to you, the loan, and even the property being purchased. They will review the file to ensure that it contains all the documents required for the underwriting process (step 5 below). These documents include bank statements, tax records, employment letters, purchase agreements, and more.

The exact steps taken by the loan processor may vary slightly from company to company. It also varies depending on the type of mortgage loan used. But that’s how it usually works. After that, you will enter one of the most important steps during the mortgage approval process – submission.

Underwriting is where the “rubber hits the road” when it comes to loan approval. It is the borrower’s job to carefully review each loan document prepared by the loan processor, to ensure that it meets the loan requirements and guidelines.

Understanding Mortgages: Documentation

The underwriter is the primary decision maker during the mortgage approval process. This individual (or team of individuals) has the authority to reject the loan if it does not meet certain predetermined criteria. The underwriter will double check to ensure that the property and the loan meet the eligibility requirements for the specific mortgage product or program used.

Relating to your loan. He or she will review your credit history, debt-to-income ratio, assets, and other aspects of your financial picture to predict your ability to make your mortgage payments.

If the borrower encounters problems during this review process, he will be able to provide the borrower with a list of conditions that need to be resolved. This is called conditional approval. A common example of a “condition” is when an underwriter requests a letter of explanation regarding a particular bank deposit or withdrawal.

In nature, and the borrower(s) can settle in a timely manner, then the mortgage loan can lead to an advance and ultimately an approval. However, if the subscriber finds a serious problem that is outside the eligibility parameters for the loan, it may be rejected. Some borrowers will sail through the underwriting process without any problems. It varies.

The 1003 Mortgage Application Form Definition

The submission is undoubtedly the most important step in the mortgage approval process, as it determines whether the problem is ultimately approved or not. You can learn more about the process here.

If the mortgage lender is satisfied that the loan and the property being purchased meets all the guidelines and requirements, they will label it “clear to close.” This means that all the requirements have been met, and the loan can be financed. Technically, this is the last step in the mortgage approval process, although there is one more step before the deal is done – and that’s closing.

Before closing, all supporting documents (or “loan documents”, as they are called) are sent to the title company chosen to handle the closing. And

Personal loan no documents required, documents required for mortgage loan prequalification, mortgage loan documents checklist, documents required for home loan, mortgage loan required documents, documents required for reverse mortgage loan, loan documents required for mortgage, documents required for loan, mortgage loan closing documents, mortgage loan documents, documents required for mortgage, sample mortgage loan documents

RECOMMENDED:

-

How Long Does Natwest Mortgage Application Take How Long Does Natwest Mortgage Application Take - Compare our best NatWest mortgage deals. Read our review of NatWest mortgages, find out how much…

-

Mortgage Loan Documents Checklist Mortgage Loan Documents Checklist - We use cookies to improve security, personalize user experience, improve marketing activities (including working with our marketing partners) and…

-

Nationwide Mortgage Application Declined Nationwide Mortgage Application Declined - Brad Finkelstein nmnbrad mailto linkedin brad-finkelstein-8b2b9a5/ Jul 13, 2022 at 11:05 am EDT Read 1 min.The Mortgage Industry…

-

Help To Buy Equity Loan Application Help To Buy Equity Loan Application - In April 2013, a grant was launched to purchase an equity loan program that will kickstart the…

-

Documents Required For Mortgage Application Documents Required For Mortgage Application - So you've decided to take the big step of buying a home, and like most of us, you…

-

Single Mortgage Application When Married Uk Single Mortgage Application When Married Uk - Applying for a mortgage as a single applicant when married is quite common in the UK. There…

-

Nationwide Mortgage Application Tracker Nationwide Mortgage Application Tracker - The central bank has raised the rate to 0.25 percent - and many banks and building societies will pass…

-

Natwest Mortgage Application Declined Natwest Mortgage Application Declined - NatWest has cut its mortgage reporting period to four months, while Santander will no longer grant automatic offer extensions.Santander…

-

Personal Loan Form Sample Personal Loan Form Sample - Personal loans are one of the most common financial transactions between shareholders. That's why we've created a simple loan…

-

Car Loan Application Form Pdf Car Loan Application Form Pdf - Send by email, link or fax. You can also download, export or print.Managing documents with our feature-rich and…

-

Capital One Business Loan Application Capital One Business Loan Application - Reserves the right to limit requests originating from unannounced automated devices, in order to create equal access for…

-

Small Business Funding Application Small Business Funding Application - Whether you are starting a new business or trying to expand an existing small business, you may need to…

-

Cotswold District Council Planning Application Search Cotswold District Council Planning Application Search - Whether you own land, need permission or are thinking of building in the Cotswolds, Cheltenham or Gloucestershire,…

-

Visa Credit Card Application Visa Credit Card Application - Money Standard Chartered Visa Infinite: Should you apply for this credit card for the "very wealthy" (even if you…

-

Joint Citizenship And Passport Application Service London Joint Citizenship And Passport Application Service London - Dual citizenship, also known as dual citizenship, is when a person has two citizenships at the…

-

Dwp Budgeting Loan Online Application Dwp Budgeting Loan Online Application - Calls are charged at 7 p.m. first minute, then 7p per minute plus phone company charges. Callers must…

-

Joint Credit Card Application Joint Credit Card Application - We are an independent ad-supported comparison service. Our goal is to help you make better financial decisions so you…

-

Sample Car Loan Application Form Sample Car Loan Application Form - Auto Loan Application Name: Address: Phone Number: (First Name) (Middle) (Last Name) (Street) APT Number (City) (State and…

-

Roku Application Installer Roku Application Installer - Roku has been a popular streaming device for quite some time. People looking to cut the cord with cable providers…

-

Harrow Council Tax Contact Number Harrow Council Tax Contact Number - Due to basic website maintenance on Saturday 8 October, some online services such as My Account and online…

-

Building A Cloud Application Building A Cloud Application - Many planners and cloud hosting providers say they have their own unique process for cloud migrations. It's true that…

-

Ealing Planning Application Search Ealing Planning Application Search - Galliford Try Partnerships and Ealing Council have signed a deal to build 470 new homes at Perceval House at…

-

Aqua Credit Card Pre Application Check Aqua Credit Card Pre Application Check - FEATURE FUNDS Pro Investing by Aditya Birla Sun Life Mutual Fund Invest Now in Selected Funds ★★★★…

-

Fresno City College Nursing Program Application Deadline Fresno City College Nursing Program Application Deadline - Nursing Program Application Period: January 13-February 10, 2023 Selected students will be placed to begin programs…

-

Metrobank Credit Card Application Metrobank Credit Card Application - Apply for any METROBANK credit card to avail exclusive deals, discounts and privileges at any partner institution. Spend hassle-free…

-

Lottery Funding Application Form Lottery Funding Application Form - Writing funding applications can be a difficult business and can sometimes be a source of anxiety or stress. Here…

-

What Is Accessible Income On Credit Card Application What Is Accessible Income On Credit Card Application - One of the biggest mistakes people make when applying for credit cards is that they…

-

Pre Approved Credit Card Application Pre Approved Credit Card Application - Did you hear a lie? Filing for bankruptcy means seven years of bad credit. Your credit after bankruptcy…

-

Application For Child Benefit Application For Child Benefit - We use cookies on our website to provide you with the most relevant experience by remembering your preferences and…

-

Application For Pmp Certification Application For Pmp Certification - Introduction: This is the final part of my preparation for the PMP® exam application. More information on PMP® exam…

-

Iphone Application Development Companies Iphone Application Development Companies - Vyosys Technologies is a web design and mobile app development company in India. Vyosys was founded in March 2013,…

-

Service Master Fm Application Service Master Fm Application - When you own a business, it is important to keep your premises clean for your employees, customers and potential…

-

Application Security And Development Stig Application Security And Development Stig - Download this white paper to learn about Parasoft's recommended approach to achieving DISA ASD STIG compliance. Your software…

-

Declined For Credit Card Declined For Credit Card - Photo: People trying to pay with another card after the first card was declined at a restaurant, "Why was…

-

Cloud Application Monitoring Cloud Application Monitoring - In this tutorial, you will perform the necessary tasks to get started monitoring your application using Oracle Management Cloud. Specifically,…

-

Master Job Application Master Job Application - Main Application Notice The general application is subject to federal and state laws against discrimination, but employers using this form…

-

Visa Master Card Application Visa Master Card Application - Have you ever wondered why people are always looking for the best credit card for payment?Most banks and credit…

-

Edf Energy Trust Application Form Edf Energy Trust Application Form - The Electricite de France (EDF) company logo and the French flag fly near the EDF power plant in…

-

Mobile Application Development Companies Mobile Application Development Companies - SMAC Tech Labs is regarded as the leading and most innovative mobile application development company in Singapore, providing iOS…

-

Sunderland Planning Application Search Sunderland Planning Application Search - Plans for new Sunderland city center road link linking Blandford Street, Brougham Street and Maritime Terrace Plans for new…

-

Application Portfolio Rationalization Tools Application Portfolio Rationalization Tools - Action to simplify current operational workflows to improve performance, reduce total cost of ownership (TCO) and improve legacy applications…

-

Application Delivery Controllers Magic Quadrant Application Delivery Controllers Magic Quadrant - The Application Delivery Controller is a key component in enterprise and cloud data centers to improve application availability,…

-

Lawful Development Certificate Application Lawful Development Certificate Application - Use of the property as 1 x ground floor 2 bed self-contained flat and 1 x 3 bed townhouse…

-

Mass License Application Mass License Application - To get a student permit, driver's license, or ID in achusetts, you must provide proof of citizenship or legal presence,…

-

Master Credit Card Application Master Credit Card Application - Mastercard as a company provides payment methods used by banks and other financial institutions. There are different types of…

-

Citizenship Passport Application Citizenship Passport Application - Proof of US citizenship is required to obtain your passport. Requirements to verify your US citizenship are strictly enforced and…

-

Child Benefit Online Apply Child Benefit Online Apply - Parents of newborns can now claim and submit Child Benefit online at Elstar Created: 09/05/2022, 17:47 By: Stella Henrik…

-

College Application Deadline College Application Deadline - Most application deadlines for the fall semester fall between September and January, depending on the school. The most common college…

-

Fbla Mobile Application Development Fbla Mobile Application Development - The fixtures for the 2022-23 season are as follows. For a complete overview, requirements and criteria for all events,…

-

Oracle-application-server Oracle-application-server - This chapter describes how you can use Enterprise Manager to manage the critical components of your Oracle middle-tier application servers that provide…

-

Jp Morgan Internship Application Process Jp Morgan Internship Application Process - The interview with JP Morgan HireVue is an important part of the bank's recruitment process. After you submit…

-

Health Lottery Funding Application Health Lottery Funding Application - There are so many reasons to grow even a small amount of food; It is so good for mental…

-

Exxonmobil Smart Card Application Exxonmobil Smart Card Application - Wish paying for gas was as easy as pulling up to the pump and not having to click painful…

-

Harrow Council Planning Search Harrow Council Planning Search - All members of the community have the right to comment on the application that concerns them. However, only comments…

-

Victor Valley College Application Victor Valley College Application - This is my first time going to college and I'm either a transfer student, a dual credit student looking…

-

Chinese Visa Application Form Chinese Visa Application Form - In this article, we will show you how to collect a Chinese tourist visa and electronically download all documents…

-

Mobile Application And Development Mobile Application And Development - Mobile app development is mostly a small and independent program. It is used to enhance existing functionality, hopefully in…

-

Application To Application Password Management Application To Application Password Management - Confidential password management is the process of storing, sharing, creating and managing privileged passwords. Privileged password management is…

-

Web Application Performance Monitoring Tools Web Application Performance Monitoring Tools - With Applications Manager's .NET application performance monitoring, you can monitor the performance of complex .NET web operations from…

-

Colleges In Texas With No Application Fee Colleges In Texas With No Application Fee - Someone famous said, "No one gets a free ride." Apparently it was wrong. In Texas, many…

-

Metro One Security Application Metro One Security Application - View full AP file photo A select group of travelers could get an easier time Tuesday to access security…

-

Mot Smart Card Application Form Mot Smart Card Application Form - In 2020 December. announced a new secure way to access the MOT Testing System (MTS) via smartphone.If you…

-

Mobile Application Penetration Testing Service Mobile Application Penetration Testing Service - Rushing to meet a tight deadline, the mobile app development team will soon complete major updates to the…

-

Application For Adverse Possession Application For Adverse Possession - Send it by email, link or fax. You can download it, send it or print it.Is the largest editor…

-

Deploy Docker Container On Aws Deploy Docker Container On Aws - Amazon Elastic Container Service (Amazon ECS) is the service you use to run Docker applications on a scalable…

-

Development Application Installer Roku Development Application Installer Roku - Update: Unfortunately the NowTV box feature has been removed so you can no longer use Plex on NowTV. See…

-

John Lewis Credit Card Application John Lewis Credit Card Application - Several John Lewis credit card customers were furious after being told that their credit limit would be reduced…

-

Cloud Application Monitoring Tools Cloud Application Monitoring Tools - Keeping your website information safe and sound is important to your digital assets. The 24x7 site is a service…

-

Operating Licence Application Form Operating Licence Application Form - Registrar Registrar Renewal of Registration Temporary Point of Sale Regulation Scope List of Registered Agents Instruction Manuals Video Tutorials…

-

Need Permission To Perform This Action Need Permission To Perform This Action - I recently had to reinstall flyins on my machine and imported my volumes and they looked fine.…

-

Kean University Graduation Application Kean University Graduation Application - From left, Lucas Hernandez; Graduate Incentive Program grantee John Simons; and Victor Manuel Suarez at Kean University in 2018.Kean…

-

Channel 4 Hunted Application Channel 4 Hunted Application - Applications for the next series of Hunted are now open, but there is not long to applyApplications for Hunted…

-

Nhs Application Form Tips Nhs Application Form Tips - It is very popular to be part of a respected social organization within the academic community. The national honor…

-

Licence Renewal Application Form Licence Renewal Application Form - Requesting the renewal of certain documents is quite common, especially if the relevant document has a limited period or…

-

Proxy Vote Application Form Proxy Vote Application Form - If a shareholder is unable to attend the meeting in person to vote on a resolution, they may appoint…

-

Web Performance Monitoring Tools Web Performance Monitoring Tools - Let's face it, the Internet is a fragile thing. Things break or slow down from time to time. allows…

-

Smartphone Application Development Companies Smartphone Application Development Companies - There is more than one way to realize the benefits of component architecture. Find the best approach for your…

-

Imperva Web Application Firewall Imperva Web Application Firewall - Imperva's portfolio of analyst-accredited application, data and cloud security solutions provide a reliable foundation for our clients' businesses. Once…

-

Regional Inventory Tracking Application Rita Regional Inventory Tracking Application Rita - List of Best Stock Market Apps in India 2022: Today, if you are a stock market trader, it…

-

Credit Card Application Declined Credit Card Application Declined - If you want to listen to me read this blog post, click the play button.When I clicked publish on…

-

Application For Divorce Form Application For Divorce Form - Divorce for NRIs in India is very complicated and people are generally unaware of the legalities. However, here we…

-

Sefa Funding Application Form Sefa Funding Application Form - A new wave of hope swept through East London on Tuesday 24 October, just before the mid-term budget speech,…

-

Application For Death Benefit Application For Death Benefit - If your loved one has passed away, you have other things to deal with besides paperwork. But sometimes it…

-

Web Application Performance Monitoring Web Application Performance Monitoring - Monitor the performance of complex .NET operations from the end-user to the database level with Application Manager's .NET application…

-

Mobile Application Development Denver Mobile Application Development Denver - Here is a comprehensive article that includes a list of 14 mobile app development companies and their businesses.Due to…

-

Open Source Application Monitoring Tools Open Source Application Monitoring Tools - There are hundreds of server monitoring tools out there, all with slightly different customer support and functionality. In…

-

Lottery Funding Application Lottery Funding Application - Writing financial applications is a difficult business and can sometimes be a source of anxiety or stress. To help you…

-

Secure Web Application Architecture Secure Web Application Architecture - Architecture Cloud Operations & Game Migration Markets News Partner Networks Smart Business Big Data Business Productivity Cloud Enterprise Strategy…

-

Kean University Online Application Kean University Online Application - Tuition and Fees, Tuition at Kean University Accommodation, meals, prices Benefits Support and facilities at Kean University Admission dates…

-

Miami Dade College Deadline Miami Dade College Deadline - Miami Dade College is an eight-campus public institution located in Miami with the largest enrollment of any college in…

-

Radio Shack Credit Card Application Radio Shack Credit Card Application - When RadioShack filed for bankruptcy in February, it marked a potential end for one of the country's most…

-

Cherwell District Council Planning Application Search Cherwell District Council Planning Application Search - Hayfield has submitted a planning application to Cherwell District Council for the £20m Hayfield Manor development, which…

-

Start Websphere Application Server Linux Start Websphere Application Server Linux - Rational Insight 1.1.1.7 > Installation > Installing Rational Insight, Rational Insight Data Services and Rational Insight Development Tools…

-

Aws Deploy Java Application Aws Deploy Java Application - In a previous post, we looked at AWS Lambda along with AWS API Gateway for implementing an HTTP API.…

-

Sample Proxy Vote Form Sample Proxy Vote Form - When shareholders are unable to attend in person to vote on a decision, they may appoint another person to…

-

Wealden Planning Application Search Wealden Planning Application Search - Council officers who abuse their powers should be prosecuted under the Fraud Act 2006, pensions are then the proceeds…

-

You Need Permission For This Action You Need Permission For This Action - Email backlogs can damage your Gmail inbox. This not only clutters up your inbox but also causes…

-

Colleges In California With No Application Fee Colleges In California With No Application Fee - A student collects food at Mount San Antonio College's mobile food pantry. Half of California's community…

-

Mobile Application Penetration Testing Mobile Application Penetration Testing - For effective penetration testing, effective analysis of a system or application is performed to identify problems and gather information…

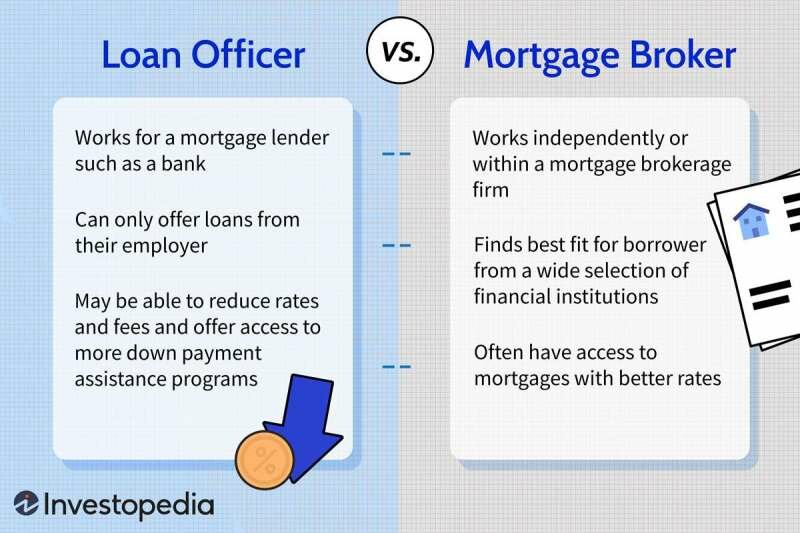

:max_bytes(150000):strip_icc()/dotdash-loan-officer-vs-mortgage-broker-5214354-Final-4c8f2e5a070a434fafcb2afa1dbe9e1b.jpg?strip=all)

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps