Visa Master Card Application – Have you ever wondered why people are always looking for the best credit card for payment?

Most banks and credit cards require you to be at least 21 years of age to apply as the primary cardholder.

Visa Master Card Application

/visa-vs-mastercard-there-difference-final-e9248e661f324cda9d141effa8b9df95.jpg?strip=all)

However, if you’re looking for a student credit card, the age requirement may drop to She’s 18+.

Amex, Visa, Or Mastercard: Which Is Best For Travel?

If a person under the age of 55 wishes to obtain a credit card, the Monetary Authority of Singapore (MAS) says he must meet at least one of the following conditions:

For Singapore Citizens or Singapore PRs, the minimum income to apply as a Primary Cardholder is generally a minimum of S$30,000 per year.

What if I have multiple cards? Do you mean different credit limits for each card?

Even if you have multiple credit cards from the same bank, they all share the same credit limit.

Icbc Virtual Digital Credit Card

If you pay your bills on time and have a good credit score, your credit limit increase request may be approved.

And finding the best one for you depends a lot on what you want in a credit card and your spending habits.

You may be surprised, but neither company issues the credit card you use.

Simply put, both Visa and MasterCard are payment networks that ensure that all money exchanged between you, the merchant from which you purchase goods, and the bank is done correctly and securely.

Visa, Mastercard And Amex Struggle As Sluggish Travel Hits Profits

A good example is the UOB PRVI Miles card, available in Visa, MasterCard and American Express versions.

Although it is true that there are some small merchants and stores that do not accept American Express.

Otherwise, CapitaLand would not issue an American Express CapitaCard, nor would there be an American Express KrisFlyer Ascend card…

But I don’t know anyone who leaves the house without a backup of her Visa or MasterCard. # Just say.

Here’s What Millennials Applying For Their First Credit Card Need To Know

Do you know how Singaporeans make this debate about East and West?

There are generally no minimum spend requirements and no limit on how many airline miles you can earn in a month (i.e. the goal is to spend more money and earn more).

Alternatively, you can earn airline miles by paying your annual credit card fee. You have to calculate if this works to your advantage.

:max_bytes(150000):strip_icc()/visa-vs-mastercard-there-difference-final-e9248e661f324cda9d141effa8b9df95.jpg?strip=all)

Or frequent flyers looking to maximize all costs to get that free first class seat at (insert dream destination).

Credit Card Promos

Or, discounts stored in your credit account until you choose to use them to offset future purchases.

These cards have minimum spending requirements if you want to qualify for higher cashback levels (you can’t earn enough without spending money…).

However, to get higher or better rewards, you must meet certain spending requirements.

First, visit Seedly Reviews to find out what credit cards are accepted in Singapore.

Paypal Visa Mastercard Stock Illustrations

You can sort cards by ‘most reviewed’ or ‘highest rated’ given by the Seedly community.

If you’re the skeptical type by nature, please note that these are unbiased reviews left by real community members.

Or…you hate them and want the whole world to know.If there’s one thing we Singaporeans do best, it’s complaining.

If you have a question, you can scroll down and get information from questions asked by other users.

Way To Ensure Your Credit Card Application Is A Success

And if you want to know which credit card is best for you (enter rewards, miles or points type), visit the Seedly X MileLion community and our community of credit card mile junkies and points enthusiasts. please give me.

Once you have decided which card to buy, go to the respective bank’s website and register the card.

At most banks in Singapore, if you are a SingPass holder, you can get a MyInfo profile with the application form pre-populated with details such as:

The logic is simple; Banks should only grant lines of credit to those who are willing to repay the amount used in time.

Amazon Singapore To Apply 0.5% Surcharge On Visa Credit Card Users

Whether you are self-employed or not, having a good credit history increases your chances of getting a credit card approved.

Usually you have to prove that your minimum annual income is her S$30,000 (or more depending on the bank and credit card you apply for).

After you receive your credit card in the mail, you must activate your credit card before you can use it.

The letter attached to your new credit card will have a number and instructions on how to activate your credit card via a confirmation SMS or phone call (usually his 24-hour automated hotline).

Credit Card Logo Decal Vinyl Sticker

Unless I ask my husband to do this because I want to lie in bed while adding cute things to my cart.

Or I don’t understand why your carrier claims to cram 1,000 free SMS into your mobile plan when it could only provide you with an extra gigabyte of data…

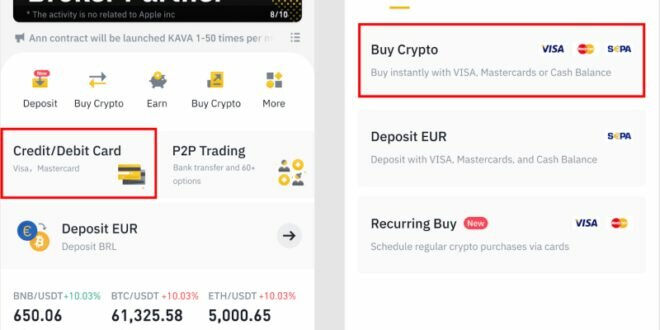

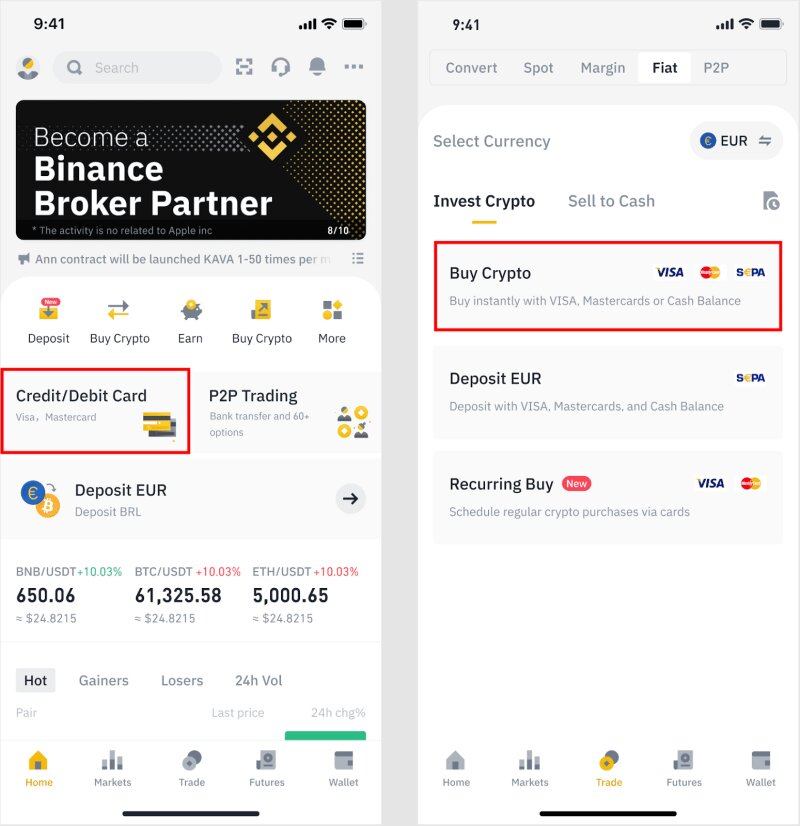

These steps are nearly identical for all other banks and their respective mobile banking applications.

Again, don’t ask your husband to do this because he can’t remember the password and needs to reset it.

Amazon To Ban Visa Credit Cards In The Uk From January

If you want to activate your credit card on a big screen, you can also activate it on your tablet, laptop, or personal computer.

Open your favorite browser (side note: pretend not to know if you’re using Safari or Bing) and visit your bank’s website.

I mean, if you ask your husband to do it because he’d rather read than waste time on mundane things like this.

If you’re near your credit card issuer’s ATM, you can also use the ATM to activate your new credit card.

Why Berkshire Hathaway Sold Out Of Visa And Mastercard

You’re going to put everyone else in line behind you, so you just want to make money to buy their bubble tea @ # $% ing.

At the ATM he spends 5 million years, inserts, presses, dispenses, moves, you have no idea what he’s doing.

Always check to see if there are any preferred credit cards or credit card promotions available before handing over your card.

Or slap yourself when you could have enjoyed a 1-for-1 buffet promotion by paying with the correct credit card.

What Investors Can Expect From Visa, Mastercard Earnings

If your card supports contactless payments, you can pay by simply holding your card over the payment reader.

If a signature is required, make sure your signature matches what is on the back of your card.

Two-factor authentication (2FA) via SMS or mobile banking app is usually required to authorize purchases.

Also, “Do you really need to buy her 4,532nd pair of sneakers?

China’s Central Bank Denies Delaying Mastercard And Visa Access To Payments Market

I threw all my money into Longcan once…because I wanted to see the cash flow. Everyone knows about the Citi Rewards Visa card. Earn 10x rewards (equivalent to 4 miles per dollar spent) on all qualifying purchases (online and offline) and online purchases. The number of 10x points you can earn is limited to 10,000. Monthly (S $ 1,000 = 4,000 miles). SingSaver is currently running a promotion where he can win S$250 for cash (sent via PayNow) by signing up for the Citi Rewards Visa card and with the weekly Lucky Him draw he wins S$1,000 there is also a chance to do so.

In June, Grab wrote about how he partnered with GovTech on his MyInfo integration and a targeted offer for some users to sign up for his virtual GrabPay Mastercard. rice field. Today, more and more users can sign up for a (virtual) GrabPay Mastercard, giving them the opportunity to earn 4 Miles per dollar spent on GrabPay with a Citi Rewards Card. I haven’t seen any official warnings from Citi, but many users have already reported success refilling his GrabPay wallet for 4 miles per dollar (up to S$1,000 per month).

Well, some of you may know that Citi and Grab announced the launch of his co-branded Citi-Grab credit card in Southeast Asia this July. Thailand. For example, Citi Priority customers in Thailand can enjoy a cash Grab discount of up to THB 1,000 every 6 months when they make eligible Grab transactions with their Citi Priority Debit Mastercard or Citi Credit Card. When using credit cards here in Singapore, some users would have gotten her EDM that 10X Rewards now (officially) applies to ride-hailing transactions as well.

TheCiti Rewards Visa Car is a great card and there is no reason not to get it (especially since a new customer has the chance to win S$250 in cash and S$1,000 in cash).

Mastercard Credit Card Vs Visa Credit Card

Master card and visa, visa master gift card, visa o master card, visa or master card, visa master card logo, visa master card number, visa master card numbers, master visa card, master card oder visa, visa master credit card, visa master debit card, prepaid master visa card

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps