How To Calculate Margin Interest – The EBITDA-to-earnings ratio is a financial ratio that is used to evaluate the health of a company by checking whether it is at least profitable to cover the amount of interest using pre-tax income. In particular it seems that the measure of earnings before interest, taxes, depreciation and amortization (EBITDA), can be used for this purpose.

The EBITDA-to-earnings ratio is also known as EBITDA. The main difference between the EBITDA ratio and the profit distribution ratio is that the latter uses profit before income and taxes (EBIT), instead of other EBITDA.

How To Calculate Margin Interest

The EBITDA-to-profit ratio is primarily used by bankers who buy the product, who will use it as a first screen to determine whether the newly restructured company will be able to meet its short-term obligations. A ratio greater than 1 indicates that the company has more than enough profit to pay dividends.

Basics Of Buying On Margin: What Is Margin Trading?

While the ratio is a very simple way to assess whether a company can cover the cost of profit, the applicability of this ratio is also limited by the importance of using EBITDA (earnings before interest, taxes, depreciation and amortization) as a proxy for different numbers. For example, suppose a company has an EBITDA-earnings ratio of 1.25; this does not mean that it will be able to cover the interest paid since the company can use a large part of the interest to replace the old equipment. Since EBITDA does not account for depreciation, a ratio of 1.25 may not be a good indicator of the economy.

There are two different methods used for EBITDA-to-profit ratio. Analysts may differ in their opinion on the importance depending on the company being analyzed. They are as follows:

For example, consider the following. The company reported revenue of $1,000,000. Salary expenses are reported to be $250,000, while utilities are reported to be $20,000. The rent is $100,000. The company also reported depreciation of $50,000 and profit of $120,000. To calculate the ratio of EBITDA to profit, the analyst must calculate EBITDA. EBITDA is calculated by taking the company’s EBIT (earnings before interest and taxes) and adding the amount of depreciation.

Next, using the EBITDA-profit formula that includes the period of rental payments, the EBITDA-to-profit ratio of the company is: and the amount of interest paid.

How To Calculate Margin Interest

Interest rate is a commonly used measure of profitability in the financial sector, for example. banks and corporate lenders.

The business model of banking is based on the nature of loans to individual borrowers or loans in order to pay interest for a certain period of time until maturity.

At maturity, the borrower must return the original principal amount to the borrower, including any accrued interest, if any (ie interest paid).

On the other hand, bank interest liabilities include customer deposits, as well as loans from other banks.

Profit Margin: Definition, Types, Formula, And Impact

If you want to compare the profitability of a bank with its industrial peers, the profit margin can be divided by the estimated value of the profitable assets.

The resulting percentage is called “net profit margin”, which is normal and therefore suitable for comparison with historical years of comparison with industry peers.

Interest Rate = Interest Income / Average Loan Portfolio Interest Income Calculation – Excel Template

“Average” is calculated as the sum of the beginning and end of the term of the outstanding bank loans, divided by two.

How Does Webull Margin Work For Beginners?

For customer deposits in the bank, the average is 200 million dollars and the interest rate is 1.0%.

Using these assumptions, we can calculate the bank’s net income of $24 million and $4 million in interest.

The difference between the bank’s net profit and net profit is $20 million, which represents the net profit for the previous year.

/dotdash-TheBalance-profit-margin-types-calculation-3305879-Final-a32cbdacec18d268837433.jpg?strip=all --> )

Subscribe to the Premium Package: Learn about Asset Management, DCF, M&A, LBO and Comps. The same training program is used in top investment banks.

Interest Margin: How Is Net Interest Margin (nim) Calculated?

We have now sent the requested file to your email. If you did not receive the email, make sure you check your spam folder before requesting the file.

Find instant video lessons taught by experienced bankers. Learn financial structure, shortcuts for DCF, M&A, LBO, Comps and Excel. Maintenance Margin, or “margin margin,” is the minimum amount of stock that must be kept in a margin account before you can call margin from the account. The value does not meet the limit.

In the context of margin accounting, the term “margin margin” refers to the minimum amount of money that must be available in order for the trade to remain profitable.

Effective trading is permitted on a margin account, where the account holder can purchase securities such as stocks, shares, or options with funds borrowed from the broker.

What Is An Ebitda Margin? Examples And How To Calculate

A margin account allows investors to trade with a percentage of the purchase price paid by the broker’s credit.

In order to be able to borrow money and trade at a profit, investors are required to keep a certain amount of money in a margin account – that is the maintenance margin.

The Financial Industry Regulatory Authority (FINRA) has set a minimum deposit requirement for custodial accounts at 25% of the net worth of the account.

At all times, the investor must meet the minimum requirements to maintain sufficient funds in the account after purchasing the loan.

Angel Broking Margin Calculator 2021

However, different staffing agencies may set these requirements, with professionals having strict maintenance procedures to prevent losses.

Product maintenance requirements may change based on many factors, such as market conditions, market fluctuations, and anticipated changes.

Investing in securities is similar to buying and selling loans – the investor uses capital borrowed from a broker and pays interest on the loan.

For example, if an investor wants to buy 240 shares in a company at $100 per share, but the investor does not have enough money to buy all the shares.

Simple Interest Calculator With Formula And Explanation

By using a margin account, an investor can buy any stock for credit.

A deposit of a fixed percentage of the total cost of the business must be made with the financing fee, ie the first deposit is the first requirement.

But if the strength falls below the maintenance limit, the investor may be forced to liquidate his position until the constraints are sufficiently met.

The procedure for calculating the maximum account value at which maintenance fees are still available is as follows.

What Is Mtd Interest (how I Ended Up With Negative Mtd Interest)

Account Cash Value Account Cash Value = Margin Loan / (1 – Cash Maintenance) Account Cash Value Calculation – Excel Template

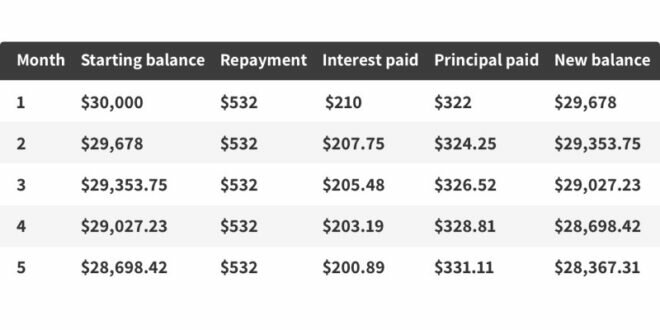

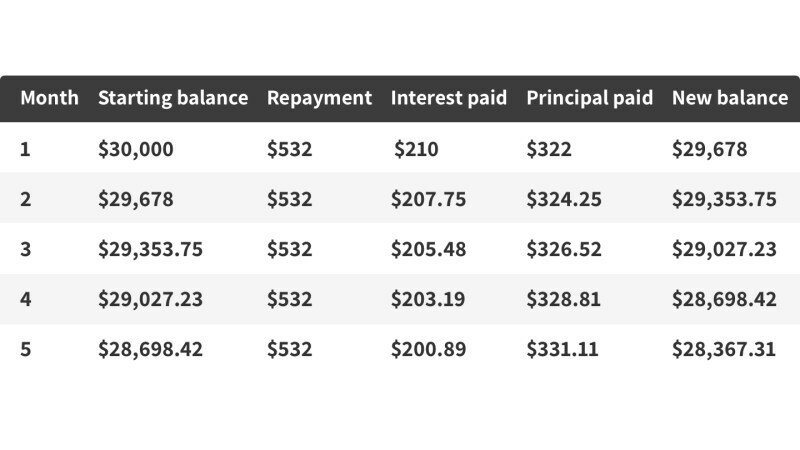

For example, let’s say an investor deposits $12,000 in a margin account and borrows $12,000 as a margin loan – in this case, $24,000 worth of shares can be purchased.

If the maintenance user is 25%, the formula for calculating the account balance that causes the call is as follows:

Subscribe to the Premium Package: Learn about Asset Management, DCF, M&A, LBO and Comps. The same training program is used in top investment banks.

Trading Faqs: Margin

We have now sent the requested file to your email. If you did not receive the email, make sure you check your spam folder before requesting the file.

Find instant video lessons taught by experienced bankers. Learn financial structure, shortcuts for DCF, M&A, LBO, Comps and Excel. You may have heard of the practice of borrowing at low interest to invest in productive assets. The difference is that you get “free money” – in a sense.

While profit trading can increase your profits, it can also increase your losses if your investments do not perform well.

With the important risk warnings out of the way, let’s find out how to build wealth fast.

Marginal Profit Calculator Big Offers, 58% Off

Stock mutual funds are a special type of financial transaction, where these funds are used to buy stocks or exchange traded funds (ETFs). is a unique loan that allows you to choose your own broker.

Sometimes you need extra money for whatever reason. You can also use mutual funds to achieve this without selling your investment.

For example, if you have a stock with a market value of $100,000, you can usually borrow 70% of its value, and put it up with the bank/broker as collateral. Answer: you can withdraw $70,000, without selling your shares.

Lenders usually have different limits on what you can borrow. In Singapore, the industry standard is 3.5x the deposit method and 2.5x for the shares held as collateral.

Profit Margin: The 4 Types, Formula And Definition

This means that if you save $100,000, you can invest $350,000. If you use $100,000 of stocks as collateral, you can invest $250,000.

For example, if you invest $100,000 in cash and earn 6% interest, the interest from

How to calculate margin requirement, how to calculate profit margin, how to calculate initial margin, calculate margin interest, how to calculate margin, how to calculate variation margin, how to calculate interest, how to calculate net interest margin, how to calculate ebitda margin, how to calculate margin requirements, how to calculate maintenance margin, calculate net interest margin

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps