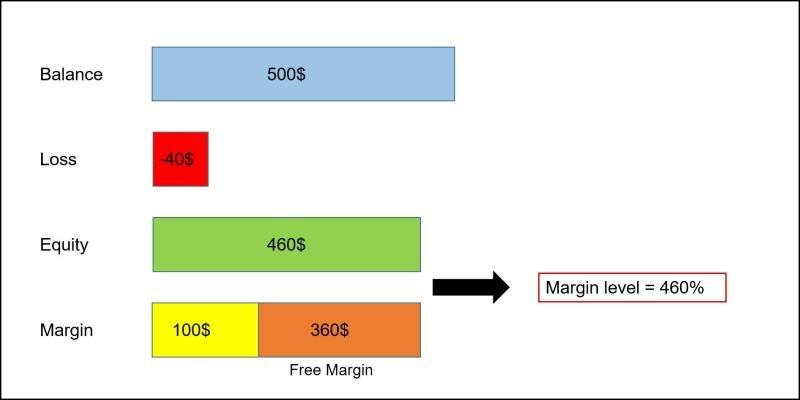

What Is Margin Level In Forex – Margin and margin requirements are something that forex traders cannot afford to ignore. Margin to open a position is often marked as “good faith margin”. Margin is usually expressed as a percentage of the full position: 0.25%, 0.5%, 1%, 2%, etc. You can calculate the maximum profit you can use in your trading account based on the margin required by your broker. Why is margin calculation important? Forex margin calculation is a deposit that a trader makes to get a position. Think of it as a bond. It’s not a fee or expense, but it makes sure your account can handle every transaction you make. The margin you need to raise depends entirely on how much you are trading. It is important not to put too much in margin because otherwise you will lose everything if your business goes bad. Currency trading is a big part of why stock traders lost so much in the 1929 crash. Be sure to keep this in mind when trading forex. The process of calculating margin in forex trading is simple. Simply multiply the trade size by the margin percentage. Then deduct the margin used for all trades from the balance in your account. The resulting number is your margin amount. How does the margin calculation work? It is possible that you are depositing a pair of funds that are not the same as the amount used in your account. As a result, margin requirements for these types of trades may be calculated in a different currency than your account currency, making margin calculations a bit more complicated. Let’s say you decide to trade GBP and JPY. The currency used in your account is USD. Let’s say you then decide to take a position with 10,000 currency units. This means you are buying 10,000 GBP equivalent to JPY. You are paying in JPY and buying in GBP, but you are actually buying JPY in USD. As far as your broker is concerned, the margin call will be calculated only in USD or your primary account currency. Here is the formula needed to calculate the margin requirements for your main account currency: Margin Requirements = ([÷] ✕ Points) / Leverage In the GBP/JPY trading example, the above formula requirements are: Base currency = GBP. Account Currency = USD Currency = Base Currency JPY / Account Currency = GBP/USD Current Exchange Units = 10,000 Base Currency/Account Currency = The exchange rate between the two trading currencies GBP/USD will be at that time. in writing, be around 1:30. Let’s use this calculation in another example using EUR/USD. Based on prices at the time of this writing, the current exchange rate for this pair is 1.21773. If you were to buy five standard units, or 500,000 units, with 30x the standard, you would need $20, $295.50 in your account to open this position. Here is another example that uses different assumptions than the previous two calculations. Let’s say you bought one level (100,000 units) of GBP/NZD margin, but your trade requires 20x margin. The current exchange rate for this currency pair is 1.90187. So the math is 100,000 units ÷ 20 ✕ 1.90187. This comes to 9,509.35 or $7,010.96, which is the limit needed to buy. Although it is important to learn how to do this calculation, you can also use margin calculators to speed up these calculations and double check your work. What is the effect of margin on leverage? Let’s not forget leverage, also known as “margin ratio.” This value may vary from one broker to another, but in general, a margin requirement of 30 times can be considered normal. In the first example above, (1.3 ✕ 10,000) ÷ 30 = $433.33 USD. In the third example described above, where 20x margin was set, the increased leverage-to-investment reduced purchasing power and profitability, providing a profit opportunity far greater than what a traditional business would provide. Here it is very easy to determine how someone is changing. Higher values may affect margin requirements. Increasing the leverage to 50x instead of 30x reduces the margin requirement to $260 USD. But this also means that your potential loss has increased by 67 percent compared to your current savings. This all seems a bit complicated. – and it can be, so it’s important to remember that margin and leverage are related. Leverage requirements ultimately determine how much you can buy as well as how much you should hold. your account to enable that position. What is the relationship between profitability and margin requirements? A low margin requirement may seem attractive because it allows you to take the same position for less dollars. However, you want to be careful because a profitable trade means you will make more money, but a bad trade means your losses are magnified. A lower limit results in a higher natural risk. When traders fail to consider the impact of this margin trading opportunity, they can experience huge losses before they know what is happening to their account. High leverage means your margin call won’t work as quickly, but you’ll lose more money as a result. High leverage also reduces your profit margin, which may deter some traders who feel that the risk-reward is not worth following a margin order. Knowing the most effective values is all part of forex trading and knowing the right values can only come with experience and time. What are the risks and benefits of margin trading? Like any trading opportunity, margin trading offers its own risks and rewards, although the risks and rewards can be increased with this trading strategy. Here are some pros and cons to consider: Reward limits allow you to generate a much larger profit than you would from your regular balance. You can quickly grow the value of your account. Margin trading can benefit from experienced traders who can evaluate the trade and make quick decisions. Less personal capital is committed to margin trading, allowing those funds to be invested in other investment opportunities. Risk Margin trading can be very risky, exposing your account to large losses based on high trading volume. Margin traders can experience a lot of anxiety about the consequences of their trades. You may get a margin call and have to top up your account or sell some of your assets to release capital to back your open position. How can you help? When it comes to forex trading, margin is something you need to deal with sooner rather than later. Fortunately, we have provided you with all the information you need to calculate forex trading and understand what the process entails.

The information presented here is for general information and educational purposes only. It is not intended and should not be taken as advice. Any disclosure of such information by you is at your own discretion and we shall not be liable in any way.

What Is Margin Level In Forex

CEO Limited, Graeme Watkins is an FX and CFD market veteran with over 10 years of experience. Key roles include administration, senior systems and controls, sales, project management and operations. Graeme has a key role in both brokerage and technology companies.

Margin Zones In Forex, Or How To Predict Price Moves

Competitive Topics (4) COVID (1) Cryptocurrency (1) Economic News Events (7) EURUSD (2) Forex Link Programs 1) 4) November 2021 Monthly Review (1) NZD (1) NZDUSD (2) ) Seminar (1) Sentiment Analysis (1) Trading Accounts (3) Trading Strategy (7) Trading Videos (6) UKOil (1) US30 ( 1) USDCAD (1) USDJPY (1) WTI (2) XAUUSD (3) Leon Bale has extensive experience writing about the financial industry. He started his career in financial trading and forex industry. With a solid understanding of market fundamentals, he currently works at AAATrade to provide research and writing… more

Leon Bale has extensive experience writing content for the financial industry. He started his career in financial trading and forex industry. With a solid understanding of market fundamentals, he currently works at AAATrade providing research and writing services.

It is a leading European investment and payment provider that provides access to 80 exchanges and multi-asset trading in stocks, forex and more.

Looking at the CCL chart, we can see yesterday’s huge decline to the support level around $9.

Forex Coaching, Announcements On Carousell

Looking at the USDJPY chart, we can see that the currency pair fell sharply from 145.78 after the intervention of the Japanese government.

Margin in forex meaning, margin level in forex, how to calculate margin level in forex, forex margin level, what is free margin in forex, what is margin in forex trading, what is free margin in forex trading, margin in forex explained, what is margin level, what is forex margin, margin in forex, what is margin in forex

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps