Buy Apple Stocks Online – You are reading a free article with opinions that may differ from the Motley Fool’s premium investment services. Become a Motley Fool member today for instant access to our top analyst recommendations, in-depth research, investment resources and more. find out more

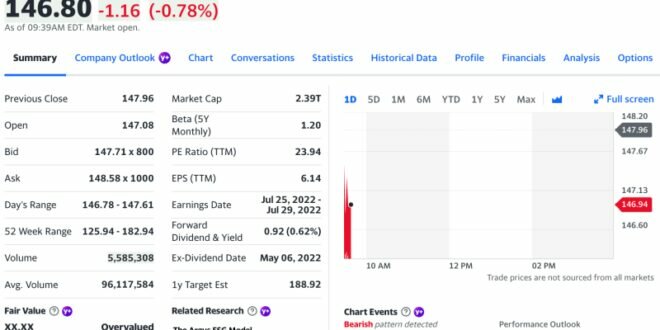

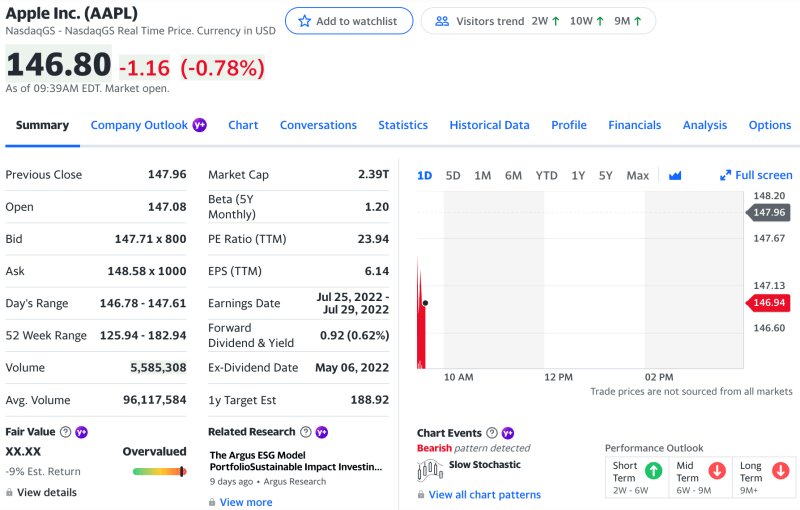

Apple (AAPL -3.00%) is one of the most innovative companies of all time. Investing in Apple seemed like a no-brainer, as its consistently successful products make the company seem unstoppable. Even as the Nasdaq-100 technology sector index has fallen 35% year over year due to inflation and slowing consumer spending, Apple’s stock has fallen 17% over the same period.

Buy Apple Stocks Online

Hugely popular products like the iPhone, MacBook, iPad and Apple Watch have boosted Apple’s market capitalization to $2.4 trillion, making it the most valuable company in the world. As a result, investors like Warren Buffett bailed on the tech maker, giving Apple 41 percent of Berkshire Hathaway’s portfolio.

Investor’s Business Daily

The iPhone titan has proven time and time again that its business is resilient and can weather most storms. However, sales of the latest iPhone may not be as positive as some have suggested. If true, the company’s biggest segment could be hit hard in the current quarter.

Over the past decade, iPhone sales have accounted for at least 40% of Apple’s revenue, with smartphones accounting for nearly 70% in some quarters. For example, the third and last 2022 In the quarter, Apple reported that iPhone sales accounted for 49 percent of its revenue. Meanwhile, the remaining revenue is as follows: 8.7% for iPad, 8.8% for Mac, 9.7% for wearables, home and accessories, and 23.6% for services.

Like clockwork, Apple announces its latest iPhone series almost every September, and sales remain steady throughout the year. But in the past few years, Apple has significantly increased its services. The introduction of apps like streaming service Apple TV+, Music, Fitness+ and iCloud pushed users into the company’s product ecosystem and increased revenue.

In 2021 services accounted for 15.7% of the company’s revenue in the fourth quarter, compared to 23.6% in Apple’s last quarter. The addition of services is a positive as it could help protect the company in the event of poor iPhone sales, which seems a real possibility with Apple’s latest lineup.

Investing Club: Apple’s Software, Chip Updates Are Nice, But Bigger Issues Are More Important To The Stock

September 7 Apple has unveiled its latest iPhone series with the iPhone 14, Plus, Pro and Pro Max. The low-end Plus model, which hasn’t appeared since the iPhone 8 Plus in 2017, is back in the lineup. Since then, the top option has only been available on Pro models with the Pro label. mostly.”

While several media outlets have reported record sales of Apple’s iPhone 14 Pro and Pro Max, a recent report from Apple analyst Ming Chu Kuo revealed poor sales of the iPhone 14 and 14 Plus. Kuo explained that Pro models are currently showing delivery wait times of more than four weeks, indicating good demand. However, the iPhone 14 and 14 Plus have been available in retail stores since their release date, which “reflects low demand.”

Weak advance sales of the non-Pro models are worrisome, as they are typically the best-selling iPhones in the annual lineup. in 2019 the base model iPhone 11 was the best-selling version every week in the last quarter of the year. Then, in the first of 2020 In the first half of the year, the iPhone 11 sold 79 percent more units than the Pro Max version and 82 percent more units than the smaller Pro model. As lower-priced base models, the Plus versions of the iPhone 14 and up would normally be superior to the Pro versions, but it doesn’t look like that in 2022.

Kuo estimates that current sales show that the iPhone 14 and Plus are selling worse than last year’s iPhone 13 mini, so Apple will have to wait until 2022. reduced production in the first half of the year due to low demand. According to Kuo, Apple may do the same with the iPhone 14 and Plus and reduce production as early as November.

In the latest iPhone 14 series, Apple has tried to widen the gap between the base and Pro models, introducing far more new features and design improvements to the more expensive versions. However, the result means that iPhone sales fared worse than in previous years due to the widening gap between last year’s iPhone 13 and 2022. “14” and rising prices abroad.

According to Bloomberg, analysts expect Apple’s sales to grow 6% in the current quarter, up from 29% last year, largely due to “pandemic-related technology users.” Demand has surged. This year, the company has been betting on its Pro models, which have achieved record numbers so far, but the question is, will the higher-end versions sell enough to make up for sluggish sales of the base model iPhone 14s?

Only time will tell, but regardless, Apple will continue to be a great investment in the long run. Although a potential downside, the company has proven over time to be an innovative company worth investing in. The stock could buy even more if it plunges, as it is unlikely to stay down much longer, suggesting that existing investors would do well to hold on until the stock rebounds.

Danny Cook has no position in any stocks. Motley holds and recommends positions for Apple. Motley recommends the following options: Long 2023 March $120 calls on Apple and short 2023 March $130 calls on Apple. The Motley Fool has a disclosure policy.

Buy And Sell Ratings On Apple, Tesla, Amazon And The 17 Other Largest Stocks In The U.s

3 Stocks to Avoid in the Dow Jones Bear Market This Week: 2 Warren Buffett Stocks You Can Buy Today 3 Dow Stocks You Can Buy Before the Market Returns Why Is Everyone Talking About Apple? 3 of my favorite stocks right now

Calculated as the average return of all stock recommendations since the launch of the Stock Advisor service in 2002. February. Return until 10/03/2022.

Calculated as time-weighted return since 2002. Volatility profiles based on estimates of the standard deviation of investment in services over the past three years.

3 Growth Stocks That Could Be Worth $1 Trillion in 10 Years – Or Where Will the Bear Market Bottom Soon? Here are the most critical indicators that Social Security recipients will actually have to keep their 2023 benefits. increases. October is your last chance to earn 9.62% risk-free.

Girl With An Apple Stock Photo By ©online.news.express.mail.gmail.com 247596426

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance and more from The Motley Fool’s premium services. One of the fastest growing investments in Asia is how to invest in Apple shares in Malaysia. Apple is a global phenomenon, its revolutionary products have made it a household name. As the share price rises, people are flocking to buy into this incredible business. Apple has a lot to offer, especially for those who like to keep up with the latest technology. If you are one of those people, now is your chance to contribute to this long-term investment in Apple shares in Malaysia.

One of the main reasons for long-term investment in Apple shares in Malaysia is that it is an industry leader. Its products are known all over the world. She has a loyal fan following in Asia. And the best part is that it uses the World Wide Web to further increase its revenue and customer base. How does she invest in Apple stock in Malaysia? This guide will show you how.

The key to determining how to invest in Apple shares in Malaysia is knowing the pros and cons. You can do this in two ways. The first thing to do is to do your homework online. The internet is full of information about various companies involved in this exciting field. Make a list of companies that you find interesting. Keep track of their financial strength, market potential, current market competition, and other factors that may influence your spending decision.

Another way to learn how to invest in Apple shares in Malaysia is to talk to locals who have been in the business for a while. You can ask about their experience. The more you know about the company and the market, the better you can make an informed decision. After all, you want to get a good return on your investment, but you don’t want to risk your money investing in a business whose future is uncertain.

How Does The Stock Market Work? Understanding The Basics

Another factor to consider when investing in Apple shares in Malaysia is whether to choose a long-term investment or an options trading plan. However, those who have done their research have decided that options trading is a good investment strategy. By buying stocks below the purchase price at the start of the option contract, you can ensure that you will make a substantial profit when the market turns in your favor. However, if you buy a stock that is more expensive when it first goes on the market, you will probably find yourself in a bind.

Buy stocks online free, buy stocks online for free, best company to buy stocks online, how to buy stocks from apple online, buy stocks online, buy otc stocks online, where to buy stocks online, how to buy apple stocks online, how to buy stocks online, buy stocks and shares online, buy stocks online app, how to buy stocks online for free

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps