Dividend Stocks Vs Index Funds – Tesla, Apple, Netflix, Google, Facebook, and you know who are the best growth stocks in the last 10-20 years? Dividend stock investor. For young investors (<40), I believe it is better to invest in growth stocks rather than dividend stocks. With growth stocks, you increase your chances of accumulating more capital quickly.

Rather than investing in a company that offers a lot of capital appreciation while you work. After all, earning dividend income is less important when you have a job income. Instead, it’s more important to build as large a financial net as possible with growth stocks.

Dividend Stocks Vs Index Funds

However, once you are retired or about to retire, you can switch to dividend stocks for income. You shouldn’t have a higher tax bill in retirement because of a lack of W2 income. Furthermore, dividend stocks are also relatively less volatile due to their strong balance sheets.

Basics Of Dividend Yield Investing (australia)

Investing in dividend stocks is a great source of passive income. In fact, I rank dividend stocks as a top source of passive income. The problem is, at a relatively low dividend yield of 1-3% you need a lot of capital to generate any kind of meaningful income. Moreover, as a minority investor, there is no way to improve the dividend payout ratio.

Even if you have a $1,000,000 dividend stock portfolio that yields 2%, that’s only $20,000 a year in dividend income. Remember, the safest withdrawal rate in retirement doesn’t touch the principle. Furthermore, you should ask yourself whether such products are worth the investment risk.

If you’re relatively young, say under 40, investing most of your equity exposure in dividend-producing stocks is a suboptimal investment strategy. Investing in growth stocks is much better than dividend stocks. You probably earn W2 income, so you don’t need more income to pay more taxes. Furthermore, your goal is to build a large capital pile as quickly as possible so that you can break free quickly.

If you decide to invest in dividend stocks when you’re young, you’ll be hoping for decades of filet mignon while eating Hamburger Helper in the meantime. As you reach your desired retirement age, you may be asking yourself, “

Pdf) Classic And Enhanced Index Funds: Performance And Issues

Of the few multi-bagger return stocks I’ve owned over the past 20 years, none of them have been dividend stocks. Over time, dividend stocks will provide healthy returns. But if you’re like me, you’ll be building your fortune sooner rather than later.

If I’m going to worry about taking risks in the stock market in the face of countless unknown endogenous and exogenous variables as a minority investor, I’m not playing for crumbs. When things go south, everything goes south. So, I want to be rewarded with the highest possible capital appreciation.

Just know that when there is a recession or a rise in interest rates, growth stocks pump more than dividend stocks. Therefore, as a growth investor, you need to be able to withstand high rates of volatility.

The main reason why companies pay dividends is because managers cannot find good growth opportunities in their company to invest their retained earnings.

How Do Dividend Stocks Work?

Another key reason is that management cannot find good acquisition opportunities with its cash. Therefore, managers return excess earnings to shareholders in the form of dividends or share buybacks.

If a company pays a dividend that equates to a 2% yield, management is essentially telling investors that they cannot find a good investment within the company that will return more than 2%.

Pretend you’re Elon Musk, CEO of Tesla Motors ( TSLA ), a growth company that pays no dividends. Do you think Elon should start paying dividends from its profits instead of putting money back into research and development for new models with longer battery life? Of course not!

It would be absolutely pathetic if Elon Musk couldn’t beat a 2% return on his capital. Tesla Motors Motors went public in mid-2010 and is the best growth stock ever.

Do Index Funds Pay Dividends?

Thanks Tesla could not pay dividends, otherwise the company could go bankrupt. Raising debt and reinvesting cash flow into the company made Tesla a successful growth story.

Now, let’s look at a telecommunications company like AT&T ( T ), which has the largest wireless network in the United States. According to Pew Research, cell phone penetration in the United States is over 88%. AT&T also has the largest customer base in the industry.

Due to the already high penetration rate, there is less opportunity for acceleration. However, the cash flow generated is high because AT&T is like a utility that keeps customers’ money in an oligopoly. As a result of strong cash flow and no good investment options, AT&T pays a fat dividend of ~$2/share, which equals a 7% dividend yield at today’s stock price.

Look at the comparison between Tesla Motor’s share price in blue and AT&T’s share price in green and there is no comparison. You can’t even tell that AT&T is on the charts. Over the past five years, AT&T is down 22.37%. Meanwhile, Tesla is up 2,340%. Which would you choose?

List Of 2022’s Best High Yield Blue Chip Dividend Stocks

I am a shareholder in both stocks and I regret buying AT&T for its dividend. While growth stocks outperformed in a low interest rate environment with high inflation and government subsidies, dividend stocks underperformed.

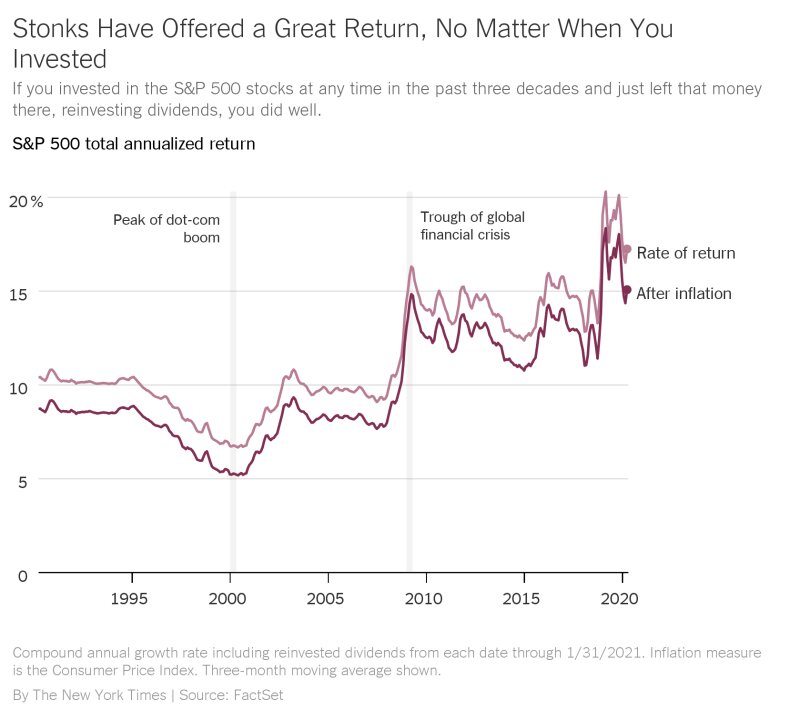

Below is a chart comparing the 5-year price performance of dividend aristocrat stocks versus growth stocks like AT&T, Coca-Cola, 3M, Procter & Gamble, and Chevron, and S&P 500 index stocks Google, Apple, and Facebook. As you can see, the difference in performance is huge. In a bull market, you want to overweight growth stocks for potential big equity returns.

Accumulating dividends is good when you have a large portfolio and are close to retirement. However, trying to grow wealth quickly through dividend stocks is a sub-optimal decision.

One of the main misconceptions about owning dividend stocks is that dividends are free money. Dividends are not free money. Paying dividends reduces the amount of cash on the company’s balance sheet, reducing the value of the company’s equity.

Should You Invest In High Dividend Stocks Or Index Funds?

Expectations are the reason a dividend stock rebounds after it pays its quarterly or annual dividend. If a company has a history of dividend payments, the amount of dividends paid by the stock will not decrease. Expectations are high that a company like Coca-Cola will generate enough cash flow to pay another dividend, as it has for decades.

If the amount of growth cannot overcome the amount of value lost from dividends over time, it is likely that the company will experience a decline in value. If you invest in a company that is not growing and is cutting its dividend payment, then you have found yourself a real fool.

One of the biggest growth stocks in history is Microsoft (MSFT). However, even growth stocks like Microsoft can’t go up forever. Microsoft stock went nowhere between 2000-2016. Thankfully for shareholders, the new CEO revived the company and capitalized on the cloud.

If you were a young man who decided to buy dividend stocks in the 1980s instead of Microsoft, you underperformed.

Index Investing Vs Dividend Investing

However, by 2003, Microsoft recognized that its Windows platform was saturated because it had a monopoly. Meanwhile, the growth of the PC was also halted. Therefore, dividends began to be paid on January 17, 2003 because the company could not find a good use of its cash.

As a dividend stock, Microsoft wasn’t bad with a 2% – 3% dividend yield for nearly a decade. The problem when you’re older is that it’s harder to grow faster. Look at the dividend stock, IBM, which has essentially gone nowhere since 1999.

Be aware of the company’s life cycle. Not all companies can evolve to take advantage of new opportunities like Microsoft did.

How many companies did we know 10 years ago that are not around today because of competition? Many could not invent. Some faced major disruptions in their business. Tower Records, WorldCom, Circuit City, American Home Mortgage, Enron, Lehman Brothers, ATA Airlines, The Sharp Image, Washington Mutual, Ziff Davis, Hostess Brands and Hollywood Video are all gone!

Mutual Funds Vs Direct Equity Investments: Which Is Better Option?

This is why you obviously can’t buy and hold a stock forever. You should stay on top of your investments at least once a year.

In a declining interest rate environment, as long as dividend paying companies continue to generate good cash flow and maintain or increase dividend payout ratios, they can be viewed more favorably. Dividend paying companies look relatively more attractive when interest rates fall.

We are currently in a low interest rate environment. Low interest rates are likely to be here for years because the Fed has promised to be extremely accommodative until inflation stays above 2% for a long time. Inflation is rising mainly due to the post-pandemic stimulus. However, the interest rate is likely to remain low.

As a result, top dividend stocks should do relatively well in a low interest rate environment. However, look how well the stock has grown.

Dividend Etfs Vs. Individual Stocks

When interest rates are low, companies can do that

Index funds or dividend stocks, high dividend stocks funds, top dividend index funds, index funds vs dividend stocks, stocks or index funds, high dividend index funds, stocks and index funds, stocks index funds, index funds vs stocks, individual stocks vs index funds, best dividend index funds, mutual funds dividend stocks

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps