Gold Stocks To Buy – You are reading an independent article with differing opinions on The Motley Fool’s premium investing services. Become a Motley Fool member today to get instant access to our favorite experts, in-depth research, investment resources and more. Learn more

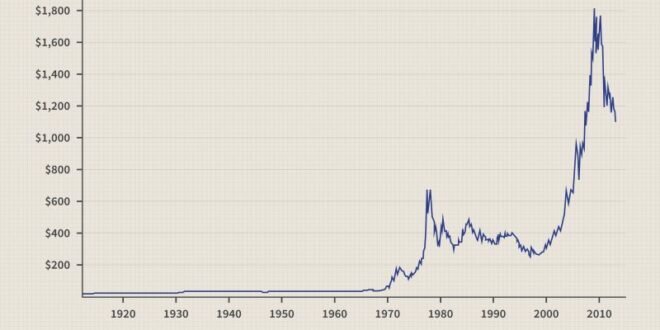

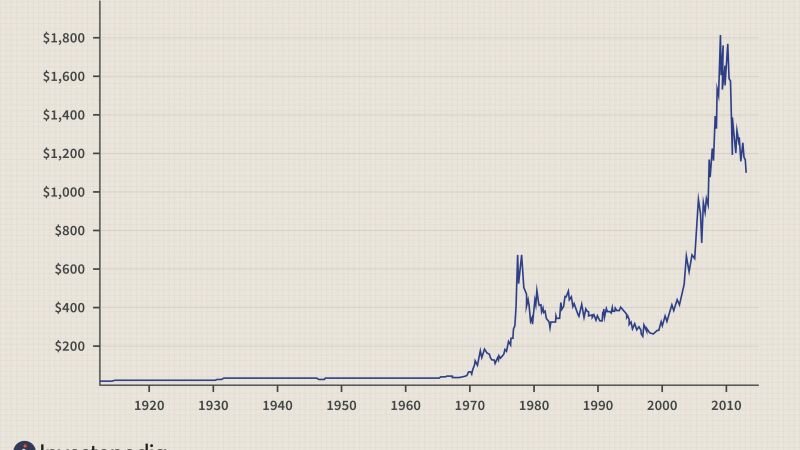

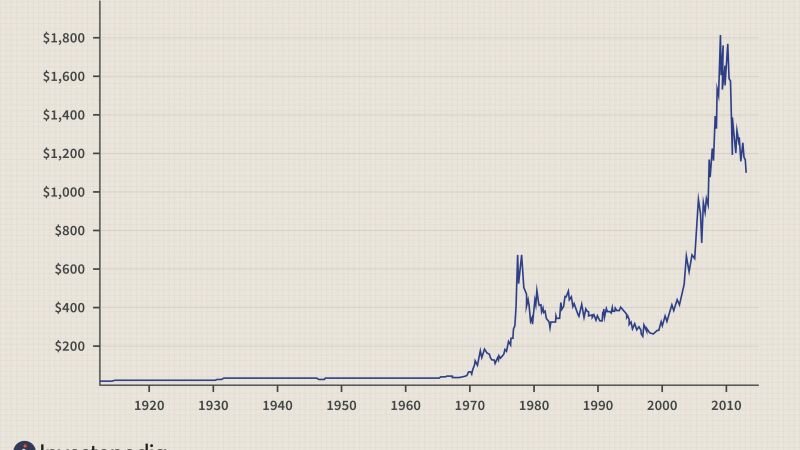

After a successful run in 2020, gold prices have fallen slightly this year. This has caused some investors to pull out of gold stores, but those in the know see this period as an opportunity to stop investing in assets used as a hedge over time. Market volatility.

Gold Stocks To Buy

The gold market is the best way to find gold, and as earnings season progresses, it’s a great time to hunt for winners with your money. If you’re wondering where to start, here are three of the best gold stocks to buy right now.

Upside: Expert Picks 3 Asx Gold Shares Attractive To Buy Right Now

Kirkland Lake Gold ( KL ) started 2021 on a bright note, being one of the few gold mining companies to lead production and price control in the most recent quarter. Kirkland produced 302,847 ounces of gold in the first quarter, beating its guidance of 280,000 ounces at the midpoint. Also, Kirkland ( AISC ) averaged $846, a line sold for gold, against AISC management’s guidance of $1,000 an ounce.

There are two things to consider here. First, the first quarter ton was prepared at the Detour Lake mine in Q1. Kirkland’s Lake Detour mine, discovered in January 2020, is the second largest mine in Canada and is important to Kirkland’s growth. Second, ore grade at Australia’s Fosterville mine, where production has slowed, has exceeded management’s expectations.

There is a lot of stockpiling and that is where the appeal of stocks lies. Initially, Kirkland expects AISC sales to end 2021 at $790-$810, which could be a shoestring especially if gold prices continue to rise.

In addition, Kirkland has implemented comprehensive plans for all three mines, particularly Detour Lake, and expects to spend $170-190 million in capital expenditures this year to increase production. It helps that Kirkland has one of the strongest divisions in the market — a low-debt, free-cash-flow, paying gold supplier. There’s a lot to like here, and with strong expectations for the second half, you might want to keep an eye on this gold.

Massive 2020s Gold And Gold Stock Bull Market Is Just Beginning

Shares of Newmont Goldcorp (NEM 0.59%) have been volatile over the past year, but investors appear to have seen the gold miner’s gains in recent weeks, up close to 17% since mid-March. Fittingly, the shutdown of the COVID-19 pandemic has affected Newmont’s production in recent months, but its growth story remains unchanged. Newmont’s stock price is showing strong FCF growth, which makes it attractive to own now. Allow me to elaborate.

Despite lower gold production in Q1, Newmont reiterated its full-year production of 7.8 million gold equivalent ounces (GEOs). In addition, Newmont plans to manufacture permanent Geos with an annual production of approximately 8 million-8.5 million units by 2025.

Here’s the real deal: Even if gold prices fall to $1,200 an ounce, Newmont could generate $3.5 billion in annual FCF over the next five years on Jio’s average annual production of 8 million ounces. For every $100 increase in gold prices, $400 million in additional FCF can be achieved. That’s great, it’s hard to find another gold mine, and if the cash flow does show up, it’s incredible. For example, Newmont hit a record $3.6 billion in FCF in 2020 at $1,775 an ounce.

Cash flow is the key to survival, growth (through mergers and acquisitions) and success for gold miners; Newmont’s revenue growth is very profitable. Also, FCF growth means higher profits, as Newmont offers an initial dividend of $1 per share at a gold price of $1, 200 ounces, and 40%-60% of the higher FCF it earns at higher gold prices. Again, this is one of the most consistent distribution policies among gold miners, and Newmont’s 3.3% yield is excellent, making it one of the best in gold buying.

Best 10 Gold Stocks For Day Trading [2022 Update]

Franco-Nevada (FNV 0.05%) is one of the safest places to buy gold for one simple reason: a miner can make a lot of money even at a high gold price, and mints are small when the price goes up. Because Franco-Nevada is not a miner, but a gold and royalty company. So it involves contracts with gold miners to buy gold from them at a predetermined price and percentage in return for their money. Since the purchase price is usually well below the gold price, Franco-Nevada wins at any gold price.

For example, I put Franco-Nevada up against the two gold mines discussed in this article to show you how the former makes more money.

I’m going to hunt down four reasons why Franco-Nevada is so hot right now:

Franco-Nevada also has an oil and gas royalty business, but this is currently only a small contribution. With a track record of multi-stream gold in one of the world’s largest active and growing mines, Franco-Nevada doesn’t have to worry about earnings growth. As money grows, so does its cash flow, dividends, and share price.

Oct 30, 2020 Gold Stocks: It’s Time To Buy Morris Hubbartt 321gold …inc …s

Neha Chamaria is not responsible for any content mentioned. The Motley Fool has no responsibility for the listed stocks. Mr. Motley has a disclosure policy.

3 Gold Stocks to Buy in 2022, Beyond Why Franco-Nevada Stocks Up 10% in 2021

Calculates the average return of all stocks since the launch of Stock Advisor in February 2002. Back on 10/06/2022.

Since 2002, time weighted return has been calculated. Volatility profile based on three-year calculation following consolidation of financial investments.

Investors Load Up On Chinese Gold Stocks, As Bullion Futures Touch New Highs On Worst Ever Us Economic Data

Social Security Retirees: Expect Big Announcement in a Week Why Neo Shares Drop Over 20% in September Big Retirement News: 3 Big Changes Coming to Social Security in 2023 Is It Safe to Invest in the Stock Market Now? Here are Warren Buffett’s tips.

Stay safe with Motley. Get stock recommendations, history tips and more from The Motley Fool’s premium services. Top Stories • How Long Will the SUCKERS Race End? • Watch for These 2 Stocks That Raised This Week • 1 S&P 500 Stock to Exchange and 1 to Avoid • 3 Blockchain Stocks to Sell Before They Break Even Below • Updated: Bear Market Game Plan! See all the top news

Gold is always in demand as it is a liquid commodity. It is known as the safest place because it can be easily recovered in case of accident. Hence, commodities often have an inverse relationship with the stock market. As the stock market becomes more uncertain, more investors move their money into the yellow metal.

Naturally, the economic and market slowdown caused by the pandemic has helped gold rise this year, before taking action during the technical period, which sent stocks higher. The yellow metal hit $2,067 an ounce in early August and is currently trading at $1,934, a gain of more than 28 percent year-to-date.

Hot Mining & Gold Stocks To Watch As Metals Surge Higher

After a brief hiatus, the precious metal has resumed its rally and is set to bounce back strongly with the market’s latest rally, technical sell-off, US dollar weakness and differences between the UK and EU Brexit. Investors are also turning to these safe-haven assets with uncertainty expected over the upcoming US presidential election.

As the mining of these precious metals directly benefits from its rising prices, their stocks will rise significantly in the coming months. Gold companies such as Agnico Eagle Mines Ltd. (AEM), Equinox Gold Corporation (EQX), Osisco Gold Royalty Ltd. (OR) and New Gold, Inc. (NGD) might be an attractive bet right now.

AEM explores and produces minerals in the United States, Canada, Europe and Latin America. The company is currently looking to expand its operations at the Kittila mines in Finland. AEM is also evaluating development opportunities at Santa Gertrudis, the Kirkland Lake Project and the Canadian Malatic Underground.

AEM returned 34.9% year over year due to uncertainty caused by the pandemic. AEM expects revenue growth of 23.2 percent this year and 25.8 percent next year. AEM’s EPS is expected to grow at an annualized rate of 53.58% over the next five years.

Gold Is Cheap. Inflation Is Coming. You Do The Math

The company, in its second-quarter earnings report, raised its 2020 guidance to a range of 1.68 to 1.73 million ounces, up from its previous guidance of 1.63 to 1.78 million ounces.

EQX focuses on the development and mining of gold-related products. Its operations include the Arizona gold mine, Castle Mountain copper projects, and the Mesquite gold mine. Acquired majority owned Ligold Mining Company

Best gold stocks to buy now, how to buy gold stocks in canada, gold stocks to buy now, best gold stocks to buy under $5, best gold stocks to buy right now, gold mining stocks to buy, best gold mining stocks to buy, buy gold stocks now, best gold stocks to buy, buy gold mining stocks, best gold mining stocks to buy now, top gold stocks to buy

RECOMMENDED:

-

Best Gold Stocks To Buy Best Gold Stocks To Buy - You are reading a free article with opinions that may differ from the Motley Fool's premium investment services.…

-

Good Buy And Hold Stocks Good Buy And Hold Stocks - You are reading a free article with opinions that may differ from Motley Fool's Premium Investing Services. Access…

-

New Stocks To Invest In 2016 New Stocks To Invest In 2016 - You are reading a free article with opinions that may differ from The Motley Fool's premium investment…

-

Buy Apple Stocks Online Buy Apple Stocks Online - You are reading a free article with opinions that may differ from the Motley Fool's premium investment services. Become…

-

Best Stocks To Invest In For 2016 Best Stocks To Invest In For 2016 - You are reading a free article with opinions that may differ from The Motley Fool's Premium…

-

Stocks To Buy Today 2016 Stocks To Buy Today 2016 - You are reading a free article with opinions that may differ from The Motley Fool's Premium Investing Service.…

-

Investing Money In Stocks Investing Money In Stocks - My investment guide for safety Investingfuturekr (66) in the hope of the project • 2 years ago I am…

-

Risky Stocks To Buy Risky Stocks To Buy - The way things are going (inflation, interest rate uncertainty, ongoing global pandemic, etc.), the stock market is going crazy…

-

Is Investing In Stocks Haram Is Investing In Stocks Haram - I have received many emails from readers over the past two years asking me about haram and halal…

-

How To Invest In Index Stocks How To Invest In Index Stocks - Investing early is important to ensure you are saving for your retirement. There are different ways to…

-

How Can I Buy Stocks In Canada How Can I Buy Stocks In Canada - The 2022 review of the best online brokers, our 12th year, took three months to complete…

-

Where To Buy Stocks Online Where To Buy Stocks Online - Disclaimer: This article contains product information from our partners. You may receive compensation if you request or purchase…

-

2016 Stocks To Invest 2016 Stocks To Invest - Sustainable Stock Investing: Building a Daily Prospecting Habit Today Learning how to pick stocks is not an easy task…

-

Top 5 Undervalued Stocks Top 5 Undervalued Stocks - Henry is the co-founder of MF & Co. Asset Management with over 15 years of experience as a trader,…

-

Good Stocks To Buy 2016 Good Stocks To Buy 2016 - The idea of buying products like you have to have them forever makes the choice more difficult and…

-

Best Brokers For Shorting Penny Stocks Best Brokers For Shorting Penny Stocks - Advertiser Disclosure: An independent review site dedicated to providing accurate information on various financial and related matters.…

-

Best Way To Buy Stocks Online Best Way To Buy Stocks Online - To buy shares, you usually need the help of a stockbroker, because you can't just call a…

-

Buy Stocks In Canada Buy Stocks In Canada - Andrew Goldman has been writing for 20 years and investing for the past 10 years. He currently writes about…

-

How To Buy Penny Stocks How To Buy Penny Stocks - Many investors are attracted to stocks because they think they can get a great return on their investment.…

-

Top Stocks Of 2016 Top Stocks Of 2016 - Research from Barclays and Novus published in October 2019 found that replicating stock selection strategies that combine consideration and…

-

Best Stocks To Buy In 2016 Best Stocks To Buy In 2016 - The stock price is an indicator of a company's market capitalization, but a stock's price will also…

-

How Can I Buy Google Stocks - With a near monopoly on the search engine industry, Google is undoubtedly one of the most successful…

-

Top 10 Best Stocks To Buy Now Top 10 Best Stocks To Buy Now - The price of a stock does not necessarily indicate its quality. But a look at all-time…

-

Cheap And Good Stocks Cheap And Good Stocks - The Indian stock market has a lot to offer. There are stocks with high returns, some with low prices,…

-

Direct Purchase Plan Stocks Direct Purchase Plan Stocks - Advertiser Disclosure: Credit card and bank offers shown on this site are from credit card companies and banks that…

-

Undervalued Oil And Gas Stocks Undervalued Oil And Gas Stocks - From MLPs to oil/natural gas producers, the energy sector as a whole is one of the most undervalued…

-

Investing In Japanese Stocks Investing In Japanese Stocks - The Bank of Japan (BoJ) increased its holdings to $434 billion in November 2020, overtaking the Japan Government Pension…

-

How To Buy Indian Stocks From Us How To Buy Indian Stocks From Us - The US stock market has some of the best stocks in the world like Facebook, Google,…

-

Top Stocks In 2015 Top Stocks In 2015 - It has been a tough year for many investors in the US capital markets. While the NASDAQ Composite is…

-

Cheap Stocks With Good Potential Cheap Stocks With Good Potential - Fear of what will happen in the future causing market pullback This creates a potential buying opportunity for…

-

How To Buy Apple Stocks Online How To Buy Apple Stocks Online - The advisory editorial team is independent and objective. To support our reporting and to continue our ability…

-

How To Short Penny Stocks How To Short Penny Stocks - Penny Stocks () is the best online destination for all Micro-Cap stocks. On your website you will find…

-

How To Invest In Indian Stocks From Us How To Invest In Indian Stocks From Us - Do you want to put your money into an international market or invest specifically in…

-

List Of Top Performing Stocks List Of Top Performing Stocks - Let's take a look at the best performing stocks over the past 10 years. The data is eye-opening:And…

-

Wheat Stocks To Buy Wheat Stocks To Buy - Home / Markets / Stock Markets / Is it a good time to invest in wheat stocks in India?India…

-

Tech Stocks To Buy 2017 Tech Stocks To Buy 2017 - DCA now contributes a certain amount each month in order to keep up with growth and gain an…

-

Renewable Energy Dividend Stocks Renewable Energy Dividend Stocks - The iShares S&P Global Clean Energy Index ETF (NASDAQ: ICLN ) gives investors exposure to global equity markets through…

-

Cramer Best Stocks Cramer Best Stocks - Throughout history, coupled with technological innovations that created the necessary infrastructure and advances in the mediocre level of financial education,…

-

10 Most Undervalued Stocks 10 Most Undervalued Stocks - Mentioned: MercadoLibre Inc (MELI) , ServiceNow Inc (NOW) , Veeva Systems Inc (VEEV) , Amazon.com Inc (AMZN) , Adobe…

-

Stem Cell Research Company Stocks Stem Cell Research Company Stocks - The global market for medical stem cells is expected to grow exponentially in the coming years. Here are…

-

Penny Stocks To Buy For 2016 Penny Stocks To Buy For 2016 - The US stock market began May 2022 with weak momentum. Some trading strengthened as investors weighed the…

-

How To Trade Penny Stocks How To Trade Penny Stocks - A white circle with a black border around the upturned chevron. It says "click here to return to…

-

Best Stocks To Invest In For Dividends Best Stocks To Invest In For Dividends - High Quality Dividend Stocks Long Term Plan The Sure Dividend Investment Method Member Area 2022 Monthly…

-

Undervalued Tech Stocks Undervalued Tech Stocks - These are the best tech stocks to invest in 2022. Investors love investing and trading tech stocks because of their…

-

Best Projected Stocks For 2017 Best Projected Stocks For 2017 - The COVID-19 pandemic has ended an 11-year bull market, and stock prices have plummeted. These are troubled times,…

-

Best Gold Stocks Cramer Best Gold Stocks Cramer - "What do you do; what do you buy when you want insurance against inflation or general economic chaos. It's…

-

Monthly Dividend Energy Stocks Monthly Dividend Energy Stocks - Quality Dividend Stocks Long Term Plan Safe Dividend Investment Method Members Area 20 Highest Monthly Dividend Stocks Right Now…

-

Short Selling Penny Stocks Short Selling Penny Stocks - Ready to start trading penny stocks? Not so fast. Before you can make your first trade, you need to…

-

Renewable Energy Stocks Renewable Energy Stocks - CFDs are complex tools. With leverage, you can quickly lose your money. Make sure you understand how this product works…

-

George Soros Buys Gold George Soros Buys Gold - Legendary investor George Soros sold 37% of his long stock and bought more gold (and gold stocks) last quarter.Soros,…

-

Top Penny Stocks Of 2016 Top Penny Stocks Of 2016 - US stock markets begin May 2022 in a period of weakness. Some were sold out as investors assessed…

-

Top 10 Best Stocks To Buy Right Now Top 10 Best Stocks To Buy Right Now - All you need to know Get updates on major market events in your inbox every…

-

Dividend Stocks Vs Index Funds Dividend Stocks Vs Index Funds - Tesla, Apple, Netflix, Google, Facebook, and you know who are the best growth stocks in the last 10-20…

-

Stocks That Pay Dividends Monthly 2015 Stocks That Pay Dividends Monthly 2015 - The yield (dividend/price) from here verified by Yahoo Finance for Monthly Dividend Paying Small, Mid and Large…

-

Undervalued Oil Stocks 2016 Undervalued Oil Stocks 2016 - Home Membership Levels About Us General Discussion Full Stock List Podcast Book Membership Data Coverage Founder's Message Free TrialAll-in-One…

-

Renewable Energy Penny Stocks Renewable Energy Penny Stocks - Penny Stocks () is the leading online destination for all micro-cap stocks. You'll find a comprehensive list of penny…

-

Toilet Paper Company Stocks Toilet Paper Company Stocks - Yesterday, I saw a video that recalls the old scene of Black Friday, where many people waited for the…

-

Best Stocks To Sell Covered Calls Best Stocks To Sell Covered Calls - Selling covered calls is a strategy that can help you make money if the stock price does…

-

Stocks Trading Above 200 Day Moving Average Stocks Trading Above 200 Day Moving Average - If you use the 200-day moving average as a buy/sell signal in your trades, you should…

-

Soros Buys Gold Stocks Soros Buys Gold Stocks - Legendary investor George Soros sold 37% of his long stocks last quarter and bought more gold (gold stocks).Soros, who…

-

Good Cheap Stocks 2016 Good Cheap Stocks 2016 - In the world of commodities, crude oil gets the headlines and gold nuggets get the attention, but sugar is…

-

Best Short Term Stocks 2016 Best Short Term Stocks 2016 - Many of the offers that appear on this website come from advertisers who are being compensated by this…

-

Software For Buying And Selling Stocks Software For Buying And Selling Stocks - When using algorithmic trading, traders commit their hard-earned money to their trading software. For this reason, proper…

-

Best Stocks For Covered Calls Best Stocks For Covered Calls - The latest edition of Tackle 25 2016 is better than ever. While Tackle 25 is not a long-term…

-

Wheat Stocks Symbols Wheat Stocks Symbols - Two dry ears of wheat. Grain culture. Harvesting crops. A symbol of agriculture. Concept of organic products. Agriculture topic. Icon…

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps