Good Cheap Stocks 2016 – In the world of commodities, crude oil gets the headlines and gold nuggets get the attention, but sugar is often left out in the cold. A good example of this is the sharp drop in the price of sugar. Since the beginning of October, its market value has decreased by 18%. Did it cause a media frenzy? Is Pat Boone Urging Investors to Buy Sugar Because of the Conglomerate’s Foreclosure?

Yes, it’s a rhetorical question. Too many people outside of the grocery store pay much attention to the price of sugar.

Good Cheap Stocks 2016

Along with that note, there aren’t many “pure” sugar substitutes. As of this writing, there are only three straight plays: the Path Bloomberg Sugar Subindex Total Return ETN (NYSEARCA:SGG ), the Teucrium Sugar Fund (NYSEARCA: CANE ), and the iPath Pure Beta Sugar ETN (NYSEARCA:SGAR ).

Earnings Roundup Week Of 2/4/2022: Part 2

Of these, only SGG has a respectable volume, and yet it is very low, averaging 55,000 shares over the past three months.

Here’s the kicker, though—sugar stocks aren’t limited to funds that track the actual price of the commodity. Instead, they involve companies that buy tons of sugar as part of their core business. Food manufacturers, especially those working in candy and sweet products, will benefit greatly from the sugar drought. For these sugar stocks, every basis point lost in the stock market means added profit.

At best – at least from their point of view – sugar deflation may be a continuing reality. The US Dollar Index shows no signs of slowing and is actually up 2% for the month so far. A strong case will certainly weigh on all goods. So there is everything about the US Federal Reserve. If Fed Chair Janet Yellen pushes for hawkish policy as many expect, it will be a long day for bulls.

It lends itself well to consumer-oriented sugar stocks. Lower prices benefit the bottom line, which allows additional revenue to grow the top line. Here are three candy companies that can win cheap candy!

Morgan Stanley Quants Embrace A Perennial Losing Strategy

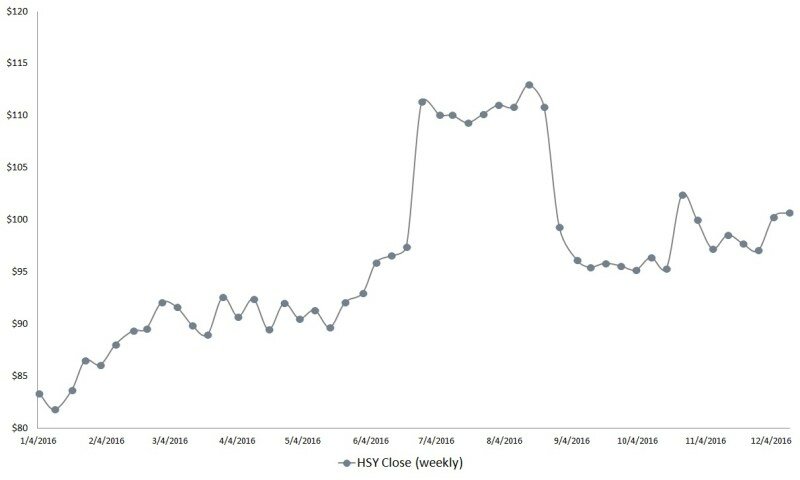

, HSY is also one of the most patriotic characters. That difference was undoubtedly helped by the fact that in 2015 HSY accounted for more than 44% of domestic chocolate demand. But another major development could push Hershey to the next level.

Recently, HSY revealed that they are exploring the idea of replacing high fructose corn syrup with sugar in certain products due to changing consumer tastes. Of course, high fructose corn syrup has caused a lot of controversy because of its unpleasant properties. Food companies love it, though, because it’s a cheaper alternative to sugar.

But with the drop in sugar prices, this is the perfect opportunity for HSY to showcase its products in the name of healthy living.

Markets are certainly buying into the HSY story. So far this year, shares are up 15%. In fact, they were even higher when rumors of a Mondelez International Inc(NASDAQ:MDLZ) takeover turned out to be more fact than fiction. But as good as that deal is, HSY has charted a steady path to what looks like a full recovery.

Bitcoin’s Price History

With commodity prices making it easy for sugar sellers to operate, HSY is a name you can’t ignore.

No company in the sugar industry has a history as rich and compelling as Tootsie Roll Industries, Inc. (NYSE:TR).

Created in 1896, inventor Leo Hirschfield named his daughter’s candy. At that time, her hand-rolled candy sold for a penny. During World War II, Tootsie Rolls were included in the rations of American soldiers as a source of “quick energy.”

Today, TR produces 64 million of its core product every day, which equates to 740 candies per second!

Value Investing Isn’t Broken

While that sounds like an amazing number, TR stock doesn’t always have a good time turning production into profit. The one-year period between late summer 2013 and 2014 was particularly difficult, with TR dropping 17% of its value. Many wondered if the company was too old to be good. However, TR eventually proved that patience is worth it. In 2016, the company increased by 30% in the market.

It’s a moment I look forward to continuing into 2017 and beyond. A quick look at TR’s earnings reveals a number of positives. It has a strong and stable balance sheet. Free cash flow remains high and influences its day-to-day operations. Profit margins are high for the sugar establishment and falling sugar prices will certainly lift all boats.

In short, TR is a smart company with rich dividends that should continue to deliver reliable returns.

Although Rocky Mountain Chocolate Factory, Inc. (NASDAQ:RMCF) other sugar organizations that time. This is a speculative opportunity to sell in the dark for the Nasdaq index.

Emerging Markets Daily

On a year-over-year basis, RMCF decreased by more than 2%. That’s nothing to be proud of, especially when so many sectors are getting strong rallies.

Despite the apparent downside and volatility, I believe there is opportunity for RMCF stock. On the first day of June, Rocky Mountain rose more than 6%. While there is nothing spectacular about that performance per se, it does show a gradual shift from bearish to bullish. The point becomes more clear when you notice that in 2015 RMCF lost almost 16% of the market. The feeling started to settle in the spring of this year, so I’m optimistic.

Integrate into the fundamentals and projects of the RMCF the object of its projected image. First, the balance sheet is stable and maintains free cash flow. Its profit margin is in the top half of sugar stocks and its three-year earnings growth is impressive. Falling sugar prices will make it easier for Rocky Mountain to focus on its energy.

RMCF is not for everyone. However, it’s a smart gamble as technology power is fueled by business interests. The share price is an index of the company’s market value, but the price per share of stock will depend on the number of shares outstanding. The reason why certain stocks are so expensive is usually because the company did not or refused to complete the stock exchange.

Are Stock Prices Too Expensive?

There are many ways to value a stock at more than net worth. Here we look at some of the biggest companies in the US and abroad.

The most expensive publicly traded stock of all time is Warren Buffett’s Berkshire Hathaway (BRK.A), which was $458,675 per share in Jan 2022. Berkshire reached an all-time high on Jan 18, 2022, at. $487, 255. Because of the amazing profits of the shareholders and the accuracy of its founder, this stock price is unlikely to correspond to anything other than the continuous increase in the stock price of Berkshire.

The next company after Berkshire, based on the price of the share called NVR (NVR) at $ 5,154.98 per share as of January 2022. Then there is Seaboard Corporation ( SEB ), which was selling at $ 3,731.02, and Amazon. com (AMZN) at $2,852.86, followed by Alphabet, Inc (GOOG) at $2,607.03 per share.

By market capitalization, as of January 2022, Apple (AAPL) is the largest company at $2.652 billion, followed by Microsoft (MSFT) at $2.222 billion, Google (GOOGL) at $1.725 billion, Amazon.com ( AMZN) at $1.446 billion, Tesla ( TSLA ) at $947.92 billion and Meta ( META ), formerly Facebook, at $843.34 billion.

Sentiment & Factor Performance

In 2007, Chinese energy giant PetroChina (PTR) reached an estimated market capitalization of $1 trillion. However, this valuation did not stick. As of January 2022, the PTR market cap was $146.95 billion.

According to the largest companies in the world by revenue, Walmart (WMT) comes first – according to the Fortune 500 list. Walmart’s revenue was 523.964 billion dollars in 2021. Behind Walmart was State Grid with $383.906 billion in revenue, followed by Amazon with $280.522 billion and China National Petroleum with $379.130 billion.

Sinopec Group is in fifth place with 407.009 billion dollars in annual revenue, and the sixth and seventh place is held by Apple and CVS Health with $ 260, 174 billion and 256.776 billion in annual revenue, respectively.

Based on the performance of only US-headquartered companies in 2020, Walmart still holds the top spot, with Amazon coming in second. Exxon Mobil is in third place and Apple is in fourth place. Health care companies take fifth, seventh, and eighth place: CVS, UnitedHealth Group, and McKesson, bringing in $256.78 billion, $242.15 billion, and $231.05 billion, respectively.

Bitcoin: Bitcoin, Tech Stocks And Xi: Top 2017 Google Financial Searches

Berkshire Hathaway ranks sixth with $254.62 billion in annual revenue, and ninth and tenth place is held by AT&T and AmerisourceBergen with $181.19 billion and $179.59 billion in annual revenue, respectively.

Looking only at the performance of US capital companies in 2019, Walmart remains at the top, with ExxonMobil ( XOM ) coming in second with $290.21 billion in annual revenue. Apple is third with $265.59 billion and Berkshire Hathaway is fourth with $247.84 billion. Health care companies occupy sixth to eighth place: UnitedHealth Group, McKesson and CVS, bringing in $226.25 billion, $214.32 billion and $194.58 billion, respectively.

As for private companies, Forbes ranks Minnesota-based Cargill as the largest private company in the United States with $134.4 billion in annual revenue. The company has 155,000 employees. Second, Koch Industries has $115 billion in revenue and 122,

Good companies with cheap stocks, cheap stocks with good potential, good cheap stocks right now, cheap and good stocks, good cheap stocks, good stocks cheap book, good cheap stocks to buy, cheap but good stocks, what are good cheap stocks, cheap good stocks buy, cheap stocks with good dividends, good cheap stocks on robinhood

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps