How To Buy Indian Stocks From Us – The US stock market has some of the best stocks in the world like Facebook, Google, Apple, General Motors, etc. By buying such stocks, you allow yourself to participate in their growth stories and allow you to diversify beyond the Indian stock market. .

There are various Indian platforms that allow you to invest in US stocks from India as there are no US stock brokers in India.

How To Buy Indian Stocks From Us

If you are wondering, can I invest in the US stock market or how can I invest in US stocks from India, the answer is, yes you can easily!

Amazon, Google, Apple & Many Others Not Listed In India

How to invest in foreign stocks directly from India? You can invest directly in the US stock market by opening a foreign trading account with a local or foreign broker Consider the charges before choosing the best app to invest in US stocks from India

Many private brokers have relationships with US stockbrokers. They act as intermediaries and execute your trades. You can open a foreign trading account with any of these brokers. It has to be done

However, it is important to note that this facility has some limitations. Depending on the brokerage firm, you may have certain restrictions on certain investment vehicles or certain trades.

Investment costs can be high considering brokerage and currency conversion fees so, make sure you know all the costs before opening an account.

Easy Ways To Invest In Foreign Stocks From India

You can open a foreign trading account directly with a foreign broker with a presence in India. Some such brokers are Charles Schwab, Imtrade, Interactive Brokers etc. Make sure you understand the fees and charges before opening an account.

So, do your research properly before choosing the best broker to invest in US stocks from India.

As with private investing, you can take an indirect position in U.S. stocks without investing in the stock directly. Here are two options to consider:

You don’t need to open a foreign trading account or keep the minimum deposit that some stock brokers may offer for direct international investment.

You can also gain exposure to US stocks by investing in ETFs. There are direct and indirect routes to ETFs. You can buy US ETFs directly through a domestic or international broker or an international index. You can buy ETFs.

Since the evolution of mobile apps for various services, several apps have been initially launched to help Indian stock investors invest in the US stock market. Some of these apps may not be allowed due to intraday trading regulatory requirements from India to the US market.

The Reserve Bank of India (RBI) has issued guidelines under the Liberalized Revenue Scheme (LRS) that allow an Indian resident to invest up to $250,000 (about Rs 1.9 crore) per year without any special permission.

Now that we know how to invest in the US market from India, let’s look at some of the reasons why you should consider investing in stocks in the US and the fees involved.

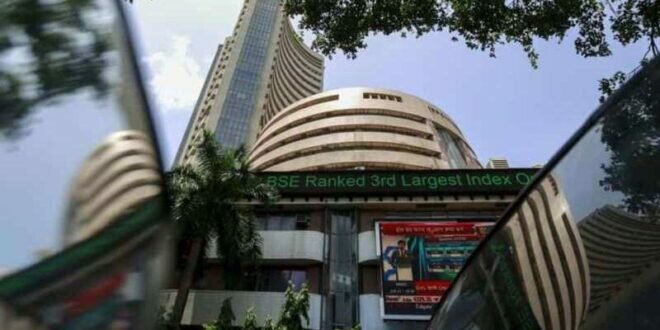

Indian Stocks Unlikely To Recoup Recent Losses, Correction Likely

5% TCS (tax collected at source) is levied on remittances above Rs 7 lakh under RBI’s Liberalized Remittance Scheme (LRS). It applies to a total amount not exceeding 7 lakh rupees

In the US, profits are taxed at the rate of 25% for Indian citizens. Due to the Double Tax Allowance Agreement (DTAA) the investor can claim credit for tax paid abroad so that he is not taxed twice on the same income. should

You do not get any capital gain on your investment in US but you are liable to pay tax on capital gains in India

Most banks charge foreign currency conversion fees and transfer fees. There may also be a one-time account setup charge

Foreign Investors Dump Record $33bn Of Indian Stocks Since October

Foreign currency exchange rates at the time of purchase or return may affect prices and the number of units allocated

By starting US stock trading from India and allowing yourself to invest in foreign markets, you can introduce an additional element of diversification to your portfolio. With information at our fingertips, stock research and analysis is easier than ever

However, it is important to remember that there are pros and cons to investing in international stocks, so make sure you consider all aspects and invest according to your financial goals and risk tolerance.

Stocks mentioned in this article are not recommended Please do your research and invest in the securities market as investment is subject to market risk, read all relevant documents carefully before investing. Please read the risk disclosure document carefully before investing in equity shares, derivatives, mutual funds, and/or other instruments traded on stock exchanges. Since investments are subject to market risk and the risk of price volatility, there can be no assurance or guarantee that investment objectives will be achieved. NBT does not guarantee guaranteed returns on any investment Past performance of securities/instruments does not indicate their future performance

Investing Directly In Us Stocks And Etfs Via Indmoney Vs Via Indian Mutual Funds

Adani Wilmar Analysis – Growth, Revenue and Technical Outlook Analysis: Arbitrage in Sun Pharma and how to leverage its trading potential? Top Small Finance Bank Stock Analysis in India: How Tata Consumer Products Differentiates in the FMCG Industry?

Stock Market Index: S&P BSE SENSEX | S&P BSE 100 | Nifty 100 Nifty 50 | NIFTY MIDCAP 100 | Nifty Bank Nifty Next 50

Public Mutual Funds: Aksi Bluechip Fund Motilal Oswal S&P 500 Index Fund Parag Park Long Term Equity Fund SBI Small Cap Fund HDFC Balanced Facility Fund | Aksha Long Term Equity Fund UTI Nifty Index Fund Axi Midcap Fund SBI Bluechip Fund Mira Asset Emerging Bluechip Fund

Mutual Fund Companies: ICICI PRUDENTIAL HDFC Nippon India Aditya Birla Sun Life SBI UTI Franklin Templeton Kotak Mahindra IDFC DSP AXIS Tata L&T Sundam PGIM Invesco LIC GM Finance | Baroda PIANIST KANARA RUBICO HSBC IDBI INDIABLES MOTEL OSWAL BNP PARBA MEERA ASSET PRINCIPAL BOI AXA UNION KBC TAURUS EDELVIS NAVI MAHINDRA QUANTITY PPFSIFL QUANTITY Mr. Sahara ITI

How To Invest In U.s. Markets From India

Tools: Brokerage Calculator | Margin Calculator SIP Calculator SWP Calculator Sukanya Samriddhi Supply Calculator Mutual Fund Calculator FD Collector RD Collector EMI Calculator PPF Calculator EPF Calculator NPS Collector Graduate Calculator

Other: NSE BSE Terms and Conditions Policy and Procedures Regulatory and Other Information Privacy Policy Disclosure Big Grace Form Download Investor Charter and Complaint Alphabet, Tesla and Amazon are among the most favorite stocks of US-based Focus Mutual Fund are organized by Here are the top 10 stocks out of 48 international funds that Indian investors can invest in, 12 in the US market. Most of them invest in technology companies listed on the US market

Retail investors in India now have the opportunity to buy US stocks directly. Both BSE and NSE have announced the introduction of a platform for Indian investors to trade in US stocks. Currently, some brokers facilitate Indian investors to buy and sell US stocks through tie-ups with US brokers. However, the mutual fund route is a viable option for Indian investors to gain exposure to US stocks. Now, there are 12 funds that invest primarily in US stocks either directly or using the funds of funds route. With low charges and professional management, it scores on many counts The US equity market is one of the most developed markets in the world The fund helps Indian investors buy stocks of companies that would otherwise be in India Allocations not available to foreign stocks also provide geographic diversification and a hedge against the US dollar. Here is a list of the top 10 stocks held by this US-focused fund. Portfolio data as of 31 July 2021

The Motilal Oswal NASDAQ 100 ETF (MON100) is a passively managed exchange-traded fund (ETF) that invests in the NASDAQ-100 index. It manages the largest asset size among US-focused funds at Rs 4,746 crore (as on 31 July 2021). The fund house also offers Fund of Funds (FoF) that invest primarily in the MON100. The Nasdaq-100 index consists of the 100 largest non-financial companies listed on the Nasdaq stock market based on market capitalization. It represents companies in computer hardware and software, telecom, retail/wholesale and biotechnology. Over the past 10 years, the MON100 has delivered a compound annual return (CAGR) of 28%. Another fund ‘Kotak Nasdaq 100 FOF’ invests in foreign ETFs of the eShares Nasdaq 100 ETF.

Stocks: Why Indian Stocks Usually Do Better Post Us Polls

Franklin India Feeder – Franklin US Opportunity Fund (FIF-FUSOF) is a unit of Foreign Fund – Franklin US Opportunity Fund (Underlying Fund). Launched in February 2012, FIF-FUSOF has delivered 20% CAGR since its inception. While the underlying fund invests primarily in the United States (95%), it also holds stocks in the United Kingdom (1.7%), Canada (1.2%) and China (0.6%). However, it is thin (about 42%) in technology stocks

Motilal Oswal S&P 500 Index Fund is a passively managed index fund that tracks the S&P 500 Index, a global index. The index invests in the top 500 companies listed in the United States and covers approximately 80% of the available market capitalization. In the last 10 years, it has delivered 20% CAGR (in INR terms).

Edelweiss US Technology Equity FOF is a core fund – a fund that invests in the JPMorgan US Technology Fund. It is a sector fund that invests in current technologies

How to buy us stocks in canada, how to buy korean stocks in us, how to buy stocks in us, how to buy australian stocks in us, us stocks to buy, how to buy indian stocks, how to buy us stocks from india, how to buy us stocks, indian stocks to buy, how to buy canadian stocks in us, how to buy us stocks in india, how to buy stocks in the us

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps