Risky Stocks To Buy – The way things are going (inflation, interest rate uncertainty, ongoing global pandemic, etc.), the stock market is going crazy high. – and we could have an interesting 2022.

As you start to look ahead to the next year and think about how to invest given all that is going on, you may want to consider other types of investments.

Risky Stocks To Buy

Or maybe you’re just starting out and wondering what to invest in as a beginner and what to avoid.

Penny Stocks Are Cheap And Often See Massive Gains, But They’re Also Very Risky. Here’s What You Should Know Before Investing

Wherever you are in your investment journey, the fact that you’re reading this means you’re already taking steps to make smart investment choices in the new year.

My goal is to help you make more money by investing, not lose money. it’s rule #1 of investing, which is why I encourage all investors to follow rule #1 to avoid risky investments.

There are many types of high-risk investments, which I will cover below, but it is important to know that these risky investments are often very attractive. So you have to be careful to avoid them.

Risky investments are often associated with high returns. That alone is the reason why people participate in this type of investment. If your luck is right, you can make a huge profit on your money, but you have a high chance of losing most (or all) of your money.

The Best Stocks To Buy Now

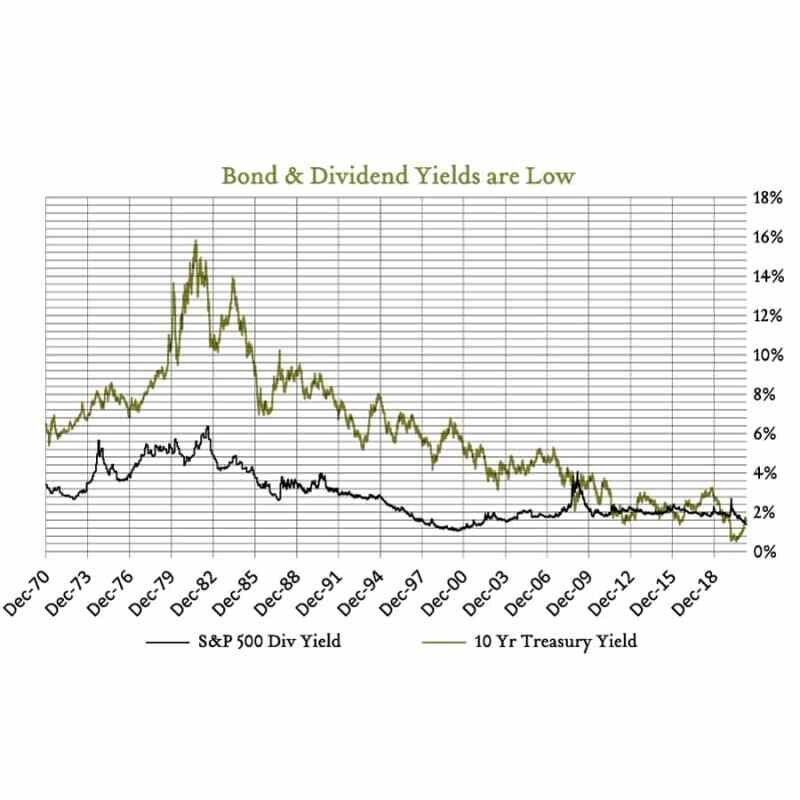

Low-risk investments are often associated with low returns, making them less attractive. Examples of low-risk investments typically include bonds, CDs, and mutual funds.

Although these types of investments are often considered “safe,” they often cannot prevent inflation. In addition to getting more money back, you could lose a lot of money that could benefit you in your retirement years.

With any type of investment, there is always some level of risk involved. None of us can predict which way the market will turn, but there are steps you can take to significantly reduce your risk.

I’ll get into how you can build wealth with cheap and high yielding investments later, but if you want to make sure you’re invested in the first place, stay away from these investments, he’s very dangerous this year…

Top Reddit Penny Stocks To Hold: The Potential Of Tamadoge To Be The Best Investment In 2022

A high-risk investment is characterized by a high probability of loss. If you are going to lose most of your initial investment or, in my opinion, any of it, then that investment is very risky.

Many people say that stocks are risky investments, but this is a broad generalization. Stocks can be one of the smartest investments if you know what you’re investing in.

One of the biggest investment mistakes people make is investing in companies they don’t understand. You probably see it all the time, and maybe you’re even guilty of doing it yourself.

You read a great article about a business, listen to its founder speak on a podcast, or like their product, so you decide to buy the company’s stock.

Indian Hotels, Irctc: Are Travel Related Stocks A Risky Bet Or A Smart Buy?

Another example of this is using a robo-advisor. When a robo-advisor makes investment decisions for you, you don’t know why they’re making those decisions.

While it may be tempting to have a bot do the work of selecting your properties for you, all it’s doing is spreading your investment across hundreds (if not thousands) of companies. ) to try to minimize the risk of losing money. You can expect lower returns with this plan.

You cannot start investing properly until you understand the businesses in which you are investing.

:max_bytes(150000):strip_icc()/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png?strip=all)

Another very common mistake and one of the main types of risky investments is buying companies at a price that exceeds their value.

Sell Off In Risky Tech Stocks Feels A Lot Like The 2000 Bubble And May Not Be Over Yet

This is Rule #1 of investing and one of the principles of all value investing strategies. buy stocks when they are sold or priced below their intrinsic value.

Currently, technology companies are among the most valuable stocks in the market. If you are thinking about investing in technology, think twice, not only because they are very expensive now, but also for these other reasons.

Everything You Need to Know About Finding and Buying Stocks Free Cheat Sheet for Value Investing

Whether its managers are inexperienced, heavily indebted, buy assets at too high a price, or make other poor decisions, a company with poor management is a risky investment.

Am I Crackers For Investing £600k Into Risky Stocks For Fun?’

On the other hand, great management, like a CEO with a track record of success and good ethics, is one of the most important aspects of smart investing.

We don’t know where the market is going, so any company you invest in in 2022 needs to be able to withstand a market correction or decline. The great moat or advantage that protects them from competition is an important part of this.

A company with an intangible brand, patented product or service, territorial control, or market price control is less likely to survive market downturns or industry-specific events.

Another type of investment that falls into this category is the leveraged exchange-traded fund (ETF). When you buy an ETF against an individual stock, you’re betting on an index or the average price of stocks in an entire sector, so you’re not benefiting from the potential returns of investing in large companies that far outperform their competitors.

Risky Stocks I Wouldn’t Buy With Free Money

Some people increase their risk even further by investing in leveraged ETFs, which aim to double or triple the returns of a stock market index, but can also double or triple losses.

One of the almost sure ways to lose all your money is to invest in the “next big thing”.

It’s important not to let the hype around a particular company or stock sway you when investing. I made this mistake back in the 90s when I invested in NeXt Computers, a high-tech company that was supposed to be the “next big thing.” But I learned my lesson.

Some common examples of this today are cryptocurrencies, IPOs (Initial Public Offerings), and meme stocks. IPOs are often too new to fully understand and never live up to the promises surrounding them to the public, and meme stocks rise or fall based on social media exposure.

Low Volatility Anomaly In The Stock Market

But cryptocurrencies are a notable example of this type of risky investment. Crypto is definitely poised to be the “next big thing” that should make the smart investor take notice. Because of the incredible volatility, your investments can get either

Rule #1 Consumers learn to manage their emotions and make informed decisions based on facts, not jokes.

Another thing every Monarch learns to do is invest for the long term. This is because the invisible hand dictates that the market will always buy companies at their true value given enough time.

However, in the short term, stock prices are heavily influenced by investor sentiment, which makes short-term investing risky.

The Best High Risk Stocks To Invest In For Aggressive Investors

A common way to invest short-term is day trading, which is buying and selling the same stocks as the day goes by to make money from price changes. This is basically gambling.

Another short-term strategy is trading options. Although call options can be a good investment strategy, they are more complicated and should not be attempted by the novice investor.

If, however, you know how options work and how to use Rule #1 investment strategy to buy or call, you can use this short-term strategy like you’re dangerous.

What’s more attractive than investing in a stock for pennies that could one day be worth thousands? This is a trap that many investors fall into. But just because you can buy penny stocks at a good price doesn’t mean you should…

Like Rule #1 investors, we always want to buy stocks when they’re “on sale,” but that’s not the same as “cheap.”

Stocks that are “sold” are priced below their intrinsic value. Although penny stocks are cheap because they don’t have much value to begin with. It is important to understand the value of a company before investing in it if you want to minimize your risk.

There are many strategies based on reducing risk. But as I said at the beginning, with most low risk policies you can expect low returns.

This means following the principles of value investing, most of which I discussed above, and sticking to the 4Ms;

Penny Stocks Trading Guide

To learn how to invest and build a successful investment portfolio in 2022, grab my Essential Investing Cheat Sheet to help grow your wealth the right way.

Phil Towne is an investment advisor, hedge fund manager, 3x NY Times best-selling author, former Grand Canyon river guide, and former lieutenant in the US Army Special Forces. He and his wife, Melissa, enjoy horses, polo and adventure. Phil’s goal is to help you learn how to invest and achieve financial independence.

Phil is a hedge fund manager and author of 3 New York Times bestselling investment books, Invested, Rule #1, and Payback Time. He was taught how to invest using strategy #1

Most risky stocks, least risky stocks, risky stocks to buy now, how risky are stocks, best risky stocks to buy right now, risky stocks, are stocks risky, are penny stocks risky, why are penny stocks risky, risky but rewarding stocks, risky penny stocks, risky stocks to invest in

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps