Stocks Trading Above 200 Day Moving Average – If you use the 200-day moving average as a buy/sell signal in your trades, you should know what is happening now.

We’ve talked a lot about market breadth over the past few months. While mega-cap growth names still provide market leadership, the S&P 500 is masking major market weakness. The benchmark index is still trading about 5% above its 200-day moving average, but the component averages don’t look very high.

Stocks Trading Above 200 Day Moving Average

:max_bytes(150000):strip_icc()/dotdash_Final_How_to_Use_a_Moving_Average_to_Buy_Stocks_Jun_2020-03-9a5827ab870c4e4bb463b18617feb88a.jpg?strip=all)

For the first time since last September, less than half of the S&P 500’s components are trading above their 200-day moving average.

Technical Indicators On Thinkorswim® To Help Find A…

The market has been in this direction throughout November and now in December. Less than a month ago, roughly 65-70% of components were trading above the 200DMA as the S&P 500 hit new highs. The width began to fall even before the index rose from the high, and I believe this number will go to the 40s and even 30s in the next few trading days.

Another signal that the market may be weakening is the strength of Treasuries, higher utility readings and lower small cap readings.

Note: Would you like to receive periodic email notifications when articles are published here? Leave your email in the box below!

The ETF Battle: Growth Stocks vs. S&P 500? It’s Vanguard vs. State Road. What is the best option for stock market investors?

Generating Trade Signals Using Moving Average(ma) Crossover Strategy — A Python Implementation

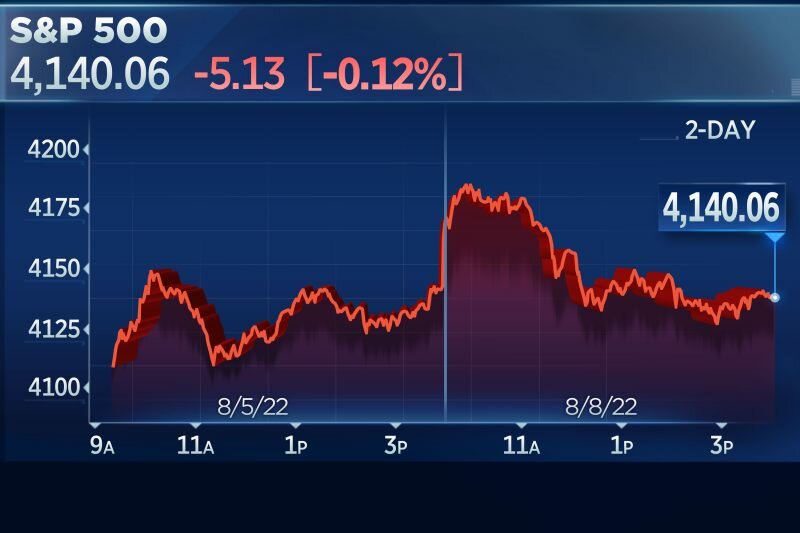

Investors had been expecting a rebound from Tuesday’s decline in the S&P 500 index. Based on history, it’s cheaper than you think. Moving average (MA) is a simple technical analysis tool that cleans price data by continuously generating price points. updated average price. Averages are taken over a specific time frame, such as 10 days, 20 minutes, 30 weeks, or any time frame the trader chooses. There are advantages to using moving averages in trading, as well as options in the type of moving averages used.

Moving average strategies are also popular and can be adjusted to any time frame that suits both long-term investors and short-term traders.

Moving averages help reduce the amount of noise in the price chart. Look at the direction of the moving average to get a basic idea of how the price will move. If it has gone up, prices have generally gone up (or recently); in the downward angle and the price moves down overall; move to the side and the price is probably in line.

Moving averages can also act as support or resistance. In an uptrend, the 50-day, 100-day or 200-day moving average can act as a support level as shown in the figure below. This is because the average acts as a floor (support), so the price rises above it. A moving average can act as resistance in a downtrend; like a ceiling, the price reaches a level and then starts to fall again.

The Anatomy Of A Retest Of The Low

Prices do not always follow moving averages in this way. The price may slightly overshoot or stop and reverse before reaching it.

As a general guideline, if the price is above the moving average, the trend is up. If the price is below the moving average, the trend is down. However, moving averages can vary in length (discussed shortly), so one MA may indicate an uptrend while another MA may indicate a downtrend.

Moving averages can be calculated in different ways. The five-day simple moving average (SMA) adds the most recent five-day closing price and divides it by five to create a new daily average. Each average connects to the other and creates a single streamline.

Another popular type of moving average is the exponential moving average (EMA). The calculation is more complicated because it gives more weight to the latest price. If you plot the 50-day SMA and 50-day EMA on the same chart, you will see that the EMA reacts to price changes faster than the SMAdoes because of the weight of new price data that is added.

Weekly S&p 500 Chartstorm: Long Term Perspective And Tactical Tips

Charting software and trading platforms do the calculations, so no manual math is required to use moving averages.

One type of MA is not better than the other. The EMA may outperform the stock market or financials at some times and the SMA may outperform at other times. The time chosen for the moving average also plays an important role in its effectiveness (regardless of the type).

Common moving average lengths are 10, 20, 50, 100, and 200. These lengths can be applied to any chart time frame (one minute, daily, weekly, etc.) depending on the time horizon of the trader. The time frame or length you choose for your moving average, also known as the “lookback period,” can play a big role in how effective it is.

MA with a short time frame responds faster to price changes than MA with a long retracement period. In the figure below, the 20-day moving average tracks the actual price more closely than the 100-day moving average.

Best 25 Technical Indicators Every Trader Should Know

The 20-day can be analytically beneficial for short-term traders because it tracks price more closely and therefore makes less than the long-term moving average. The 100-day MA may be more useful for long-term traders.

Lag is the time it takes for a moving average to show potential changes. Remember that as a general guideline, if the price is above the moving average, the trend is up. Thus, when the price falls below the moving average, it signals a potential reversal based on the MA. The 20-day moving average provides more reversal signals than the 100-day moving average.

The moving average can be: 15, 28, 89, etc. Adjust moving averages to provide more accurate signals on historical data.

Crossover is one of the basic moving average strategies. The first type is price correlation, which signals potential trend reversals when prices move above or below a moving average.

How To Master The Best Moving Averages For Day Trading

Another strategy is to use two moving averages on the chart: one longer and one shorter. When the short-term MA crosses the long-term MA, it is a buy signal, as it indicates an uptrend. This is known as the golden cross. Meanwhile, when the short-term MA falls below the long-term MA, it is a sell signal, as it indicates a downward trend. This is known as the dead/death cross.

Moving averages are calculated based on historical data and nothing about the calculation is predictive in nature. Therefore, the results using moving averages can be random. Sometimes the market seems to respect MA support / resistance and trading signals and other times it shows a lack of about these indicators.

One of the main problems is that when the price action becomes clear, the price can go back and forth, causing some trend reversals or trading signals. When this happens, it is better to use breakouts or other indicators to clarify the trend. The same thing can happen with MA crossovers, when the MA is “confused” over time, causing many trades.

Moving averages work well in strong trend situations but not well in wave or volatile situations. Adjusting the time frame can temporarily solve this problem, but at some point this problem will occur regardless of the time frame chosen for the moving average.

More Than Half Of S&p 500 Stocks Now Trade Below Their 200 Day Moving Average

Moving averages simplify price data by smoothing and creating a single trend line. This makes it easier to see trends. Exponential moving averages respond to price changes faster than simple moving averages. In some cases this can be a good thing, while in others it can lead to false alarms. Moving averages with a shorter lookback period (for example, 20 days) respond to price changes more quickly than those with a longer lookback period (200 days).

Moving average crossovers are a popular strategy for entry and exit. MAs can also highlight areas of potential support or resistance. Although it may seem predictable, moving averages are always based on historical data and represent average prices over time.

Investing using moving averages or other techniques requires an investment account with a stock broker. Our list of the best online brokers is a great place to start your research on the broker that best suits your needs.

Require writers to use primary sources to support their work. These include white papers, government data, original reports and interviews with industry experts. We also link to original research from other reputable publications where appropriate. You can learn more about the standards we follow when creating accurate and unbiased content in our editorial policy.

Analyzing Market Breadth: Kickin’ It With Old School …

The offers listed in this table apply to compensation partnerships. This compensation can affect how and where listings appear. excluding all offers available in the market. The 200-day simple moving average (SMA) is a key indicator used by traders and market analysts to identify overall long-term market trends. The indicator appears as a line on the chart and moves higher and lower with the long-term price movement of the stock, commodity, or whatever instrument it is plotting.

SMA 200 days is sometimes seen

Stocks trading below 200 day moving average, trading 200 day moving average, 200 moving average stocks, above average moving, moving average trading strategy, 200 day moving average stocks, 200 day moving average chart, 200 day moving average strategy, stocks 50 day moving average, stocks above moving average, stocks above 200 day moving average, above 200 day moving average

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps

GoInspiration | Best Forex, Stock, Gadget, and Internet Information Apps